SAND breakout, rally will be 15%? Root cause assessment

- SAND's open interest rose 5.6% in the last 24 hours following a bullish breakout.

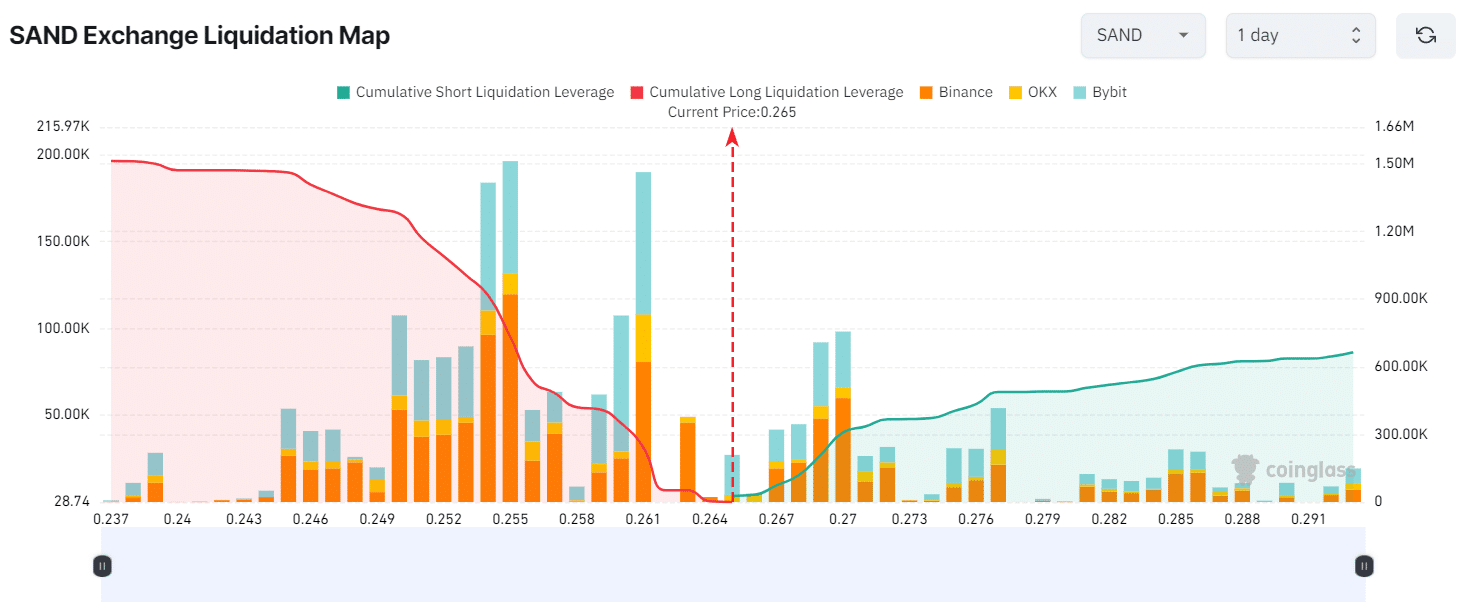

- Key liquidation levels were $0.255 and $0.27, with traders overleveraging these levels.

The overall cryptocurrency market is experiencing a significant recovery.

Among these is the virtual gaming platform The Sandbox [SAND] A strong bullish pattern broke out and shifted the sentiment from downtrend to uptrend.

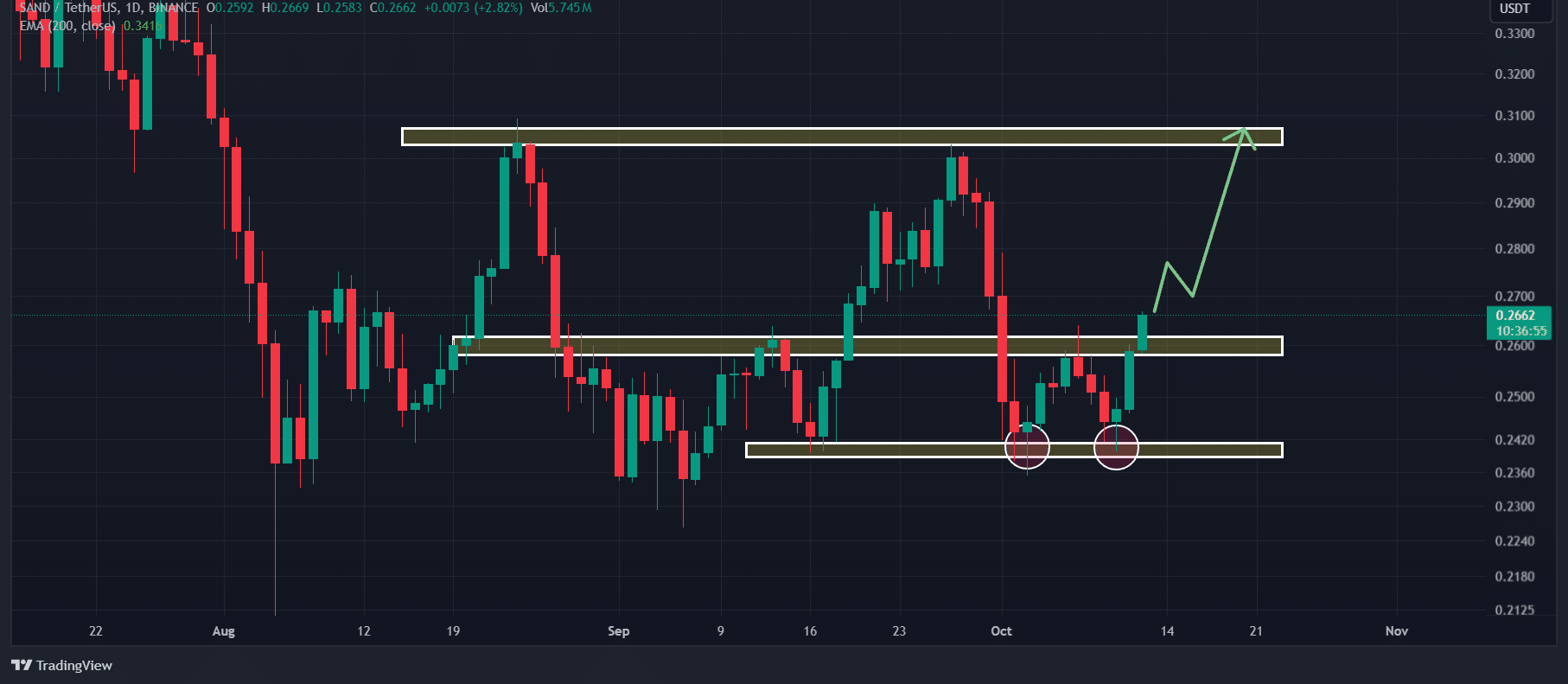

SAND Technical Analysis and Key Levels

According to AMBCrypto's technical analysis, SAND was looking bullish at press time as it broke out of a double-bottom price action pattern. The breakout was confirmed by the close of the daily candle above the neckline.

Source: TradingView

Based on the recent price performance, if SAND closes a daily candle above $0.264, it could gain 15% to reach the $0.305 level in the coming days.

Additionally, SAND's Relative Strength Index (RSI) stood at 52.30 at press time, indicating a possible upside rally ahead.

Despite SAND's bullish outlook, the 200 exponential moving average (EMA) indicates a bearish trend. When an asset trades below the 200 EMA, traders and investors generally consider it to be in a downtrend and vice versa.

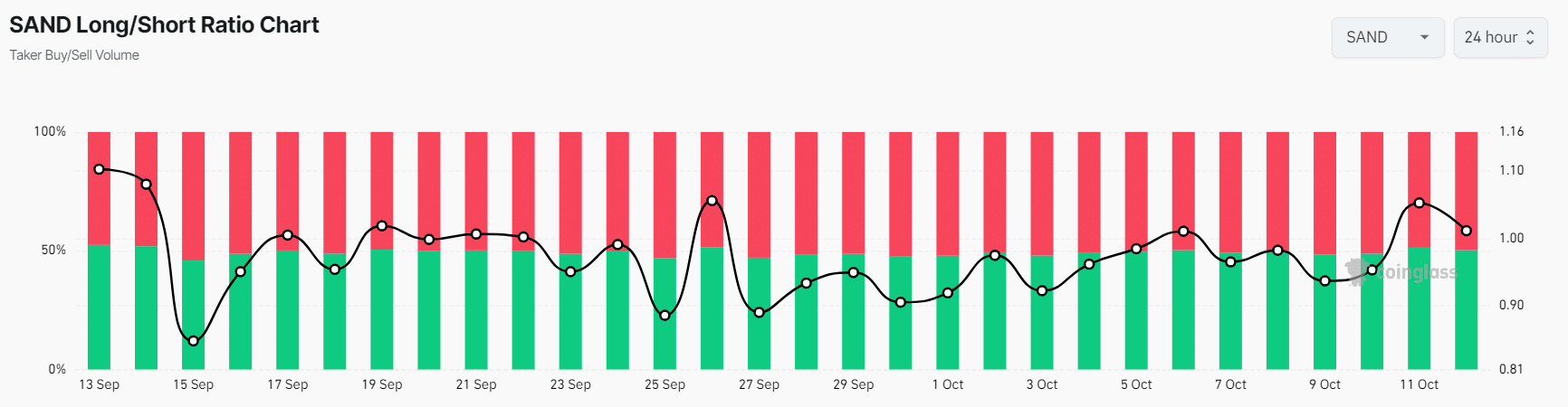

SAND's bullish on-chain metrics

SAND's bullish outlook is further supported by on-chain metrics. According to on-chain analytics firm Coinglass, SAND's long/short ratio at press time was 1.03, indicating bullish market sentiment.

Source: Coyonglas

Additionally, its futures open interest rose 5.6% in the last 24 hours and 3.91% in the last four hours.

This suggests increasing trader interest in the SAND token following the breakout of the double-bottom price action pattern.

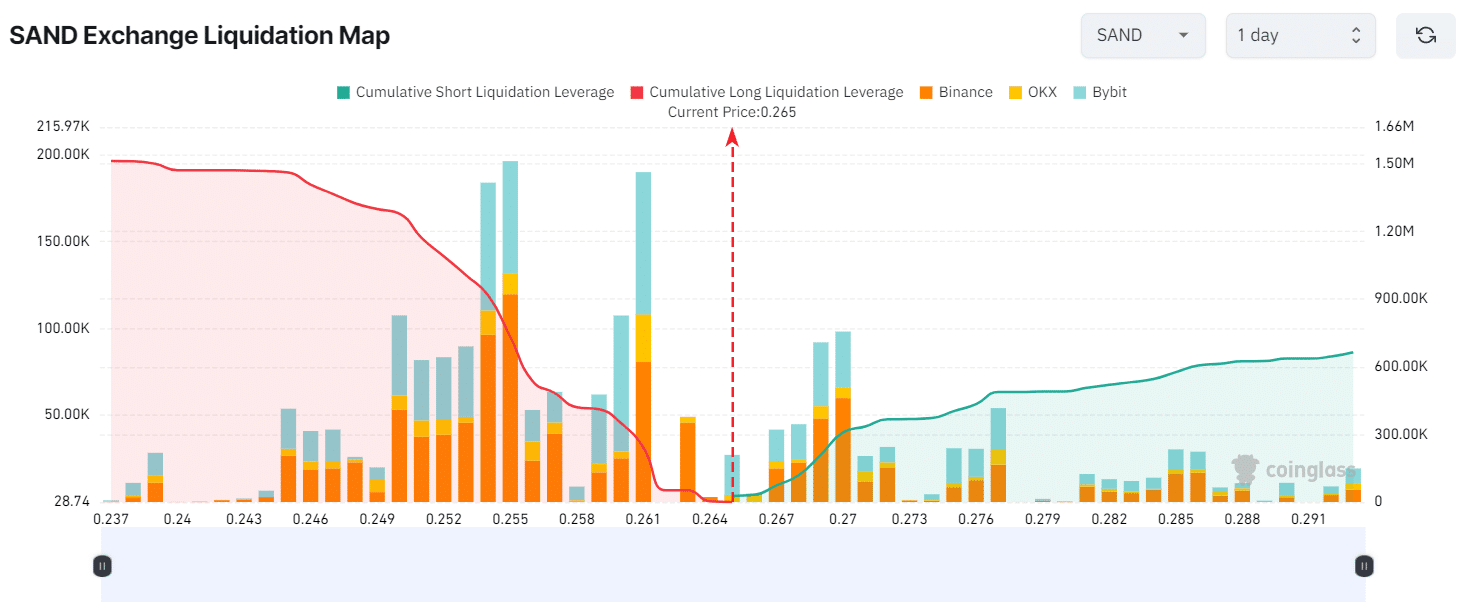

Main liquidity level

So far, the main liquidation levels are $0.255 on the downside and $0.27 on the upside, with traders over-leveraging these levels, according to Coinglass.

Source: Coyonglas

If the market sentiment remains unchanged and the price rises to the $0.27 level, the short position worth about $308,620 will be liquidated.

Conversely, if sentiment changes and the price falls to the $0.255 level, the long position worth about $732,960 will be liquidated.

This liquidation data shows that long bull positions more than double bear short positions.

Combining all these on-chain metrics with technical analysis, it appears that bulls are currently dominating the asset and are likely to support SAND in an upcoming upside rally.

Read the sandbox [SAND] Price Forecast 2024-2025

Current price momentum

At press time, SAND is trading near $0.266 and has gained more than 5.2% in the past 24 hours.

At the same time, its trading volume declined by 6%, indicating less participation by traders and investors.