PEPE's 27% gain in 30 days at risk? Here's why…

- Despite trading within a broadly bullish framework, PEPE may be forced to look for strong support zones.

- If PEPE is unable to clear this resistance, an extended accumulation phase may follow.

Pepe [PEPE] Had an impressive run last month, gaining 23.7%. However, these gains are now at risk, with PEPE slowly losing momentum.

Currently, the asset is down 2.46% on the daily chart, indicating a possible continuation of this downward trend.

According to AMBCrypto's recent analysis, this decline may continue, as current market sentiment is bearish, with limited buying pressure to maintain upward momentum in PEPE's price.

PEPE faces a major obstacle

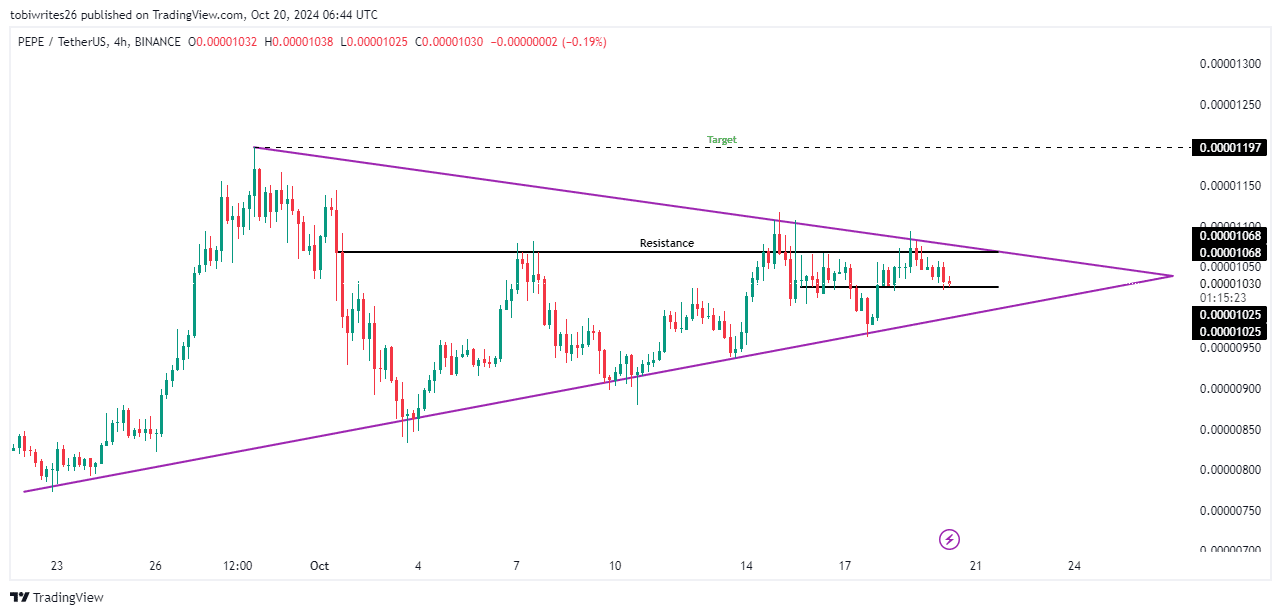

At press time PEPE was trading in a symmetrical triangle, a pattern that is usually seen as a precursor to a price breakout after accumulation.

The token recently reacted to resistance at $0.00001068, a level that has rejected the price rally twice, indicating significant selling pressure in the region.

During this period, PEPE was near the support level of $0.00001025. Suppose this support holds and sufficient buying pressure emerges.

In that case, the price is expected to rebound, potentially retesting the resistance level and breaking the pattern, pushing PEPE towards the upper boundary of the triangle.

Source: TradingView

However, if this support level fails to hold, PEPE could retrace further to the lower support of the ascending triangle, an area of high liquidity that could generate enough buying momentum to push prices higher.

Will PEPE's support level hold?

According to AMBCrypto's results, PEPE's current support level does not seem to hold, as technical indicators suggest increased selling pressure from traders.

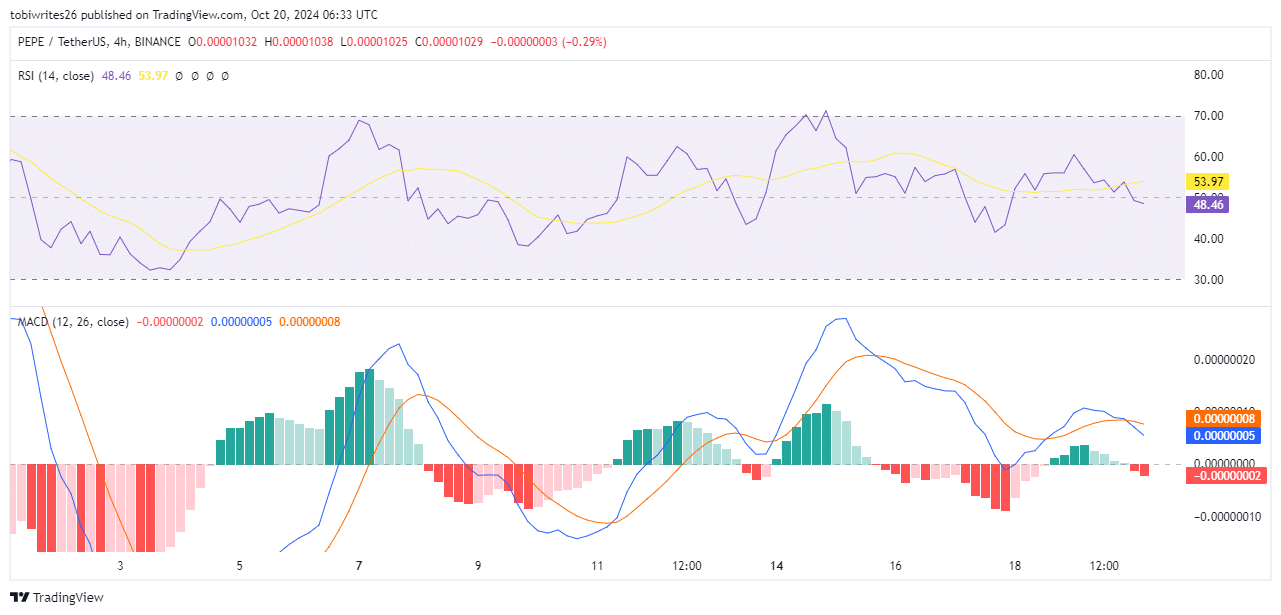

The Relative Strength Index (RSI) is currently at 48.46, below the neutral 50.00 mark, indicating that market sentiment is bearish and PEPE may be priced similarly.

RSI measures the speed and volatility of price movements in an asset.

Moving Average Convergence Divergence (MACD) has formed a “death cross”, with downward momentum gaining strength.

This occurs when the MACD line (blue) crosses below the signal line (red), signaling that traders are more interested in selling assets than holding them.

Source: TradingView

If this trend continues, PEPE may break below its support level, leading to further declines.

Interest in PEPE began to fade

Open interest, which is used to measure market sentiment by tracking whether participants are buying or selling, indicates that selling pressure is increasing at press time.

Read Pepe [PEPE] Price Forecast 2024-2025

According to data from Coinglass, open interest in PEPE decreased by 3.61%, with a current value of around $165.20 million.

This decline in open interest indicates that further price declines are likely for PEPE, making a decline from current levels seem inevitable.