Mixed Signals in the DOT Market: What's Next for Polkadot Prices?

- The value of DOT faces a key threshold; If it could break the current supply level, a rally could follow.

- Technical indicators are sending mixed signals – some are suggesting a bullish shift, while others are indicating continued bearish pressure.

Polkadots for the past month [DOT] Performance was dull with a dominant bearish sentiment leading to a fall of 18.97%.

DOT's next move remains uncertain as conflicting metrics keep market sentiment divided, leaving room for volatility throughout the coming trading session.

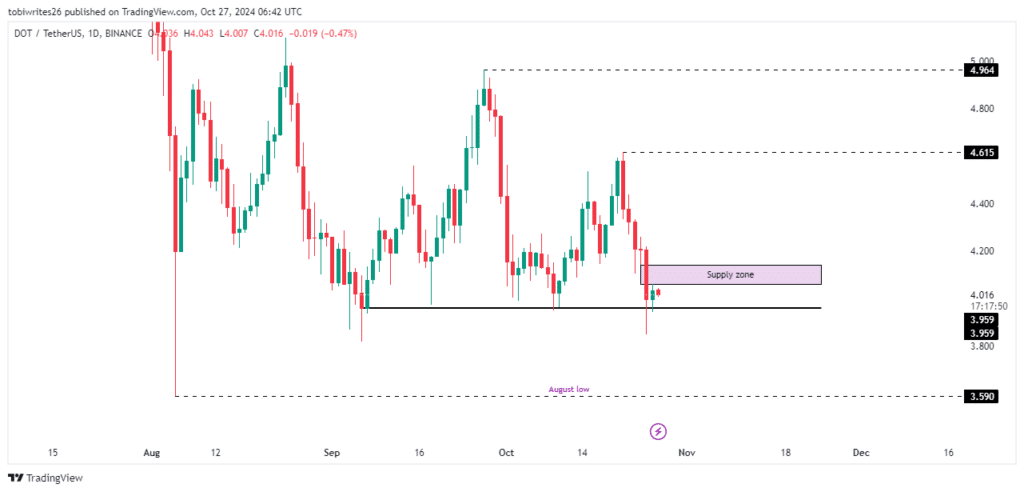

DOT is stuck between key layers

The DOT is currently trading between two significant levels that could shape its direction in the upcoming session.

After recently bouncing a support level at 3.959, DOT could rally to 4.615 or 4.964 if this support holds. However, a supply zone is directly above, which could trigger selling pressure and push prices lower, potentially returning to the DOT's August low.

Source: TradingView

To assess potential movements, AMBCrypto analyzed technical indicators, but found mixed signals, leaving the outlook uncertain.

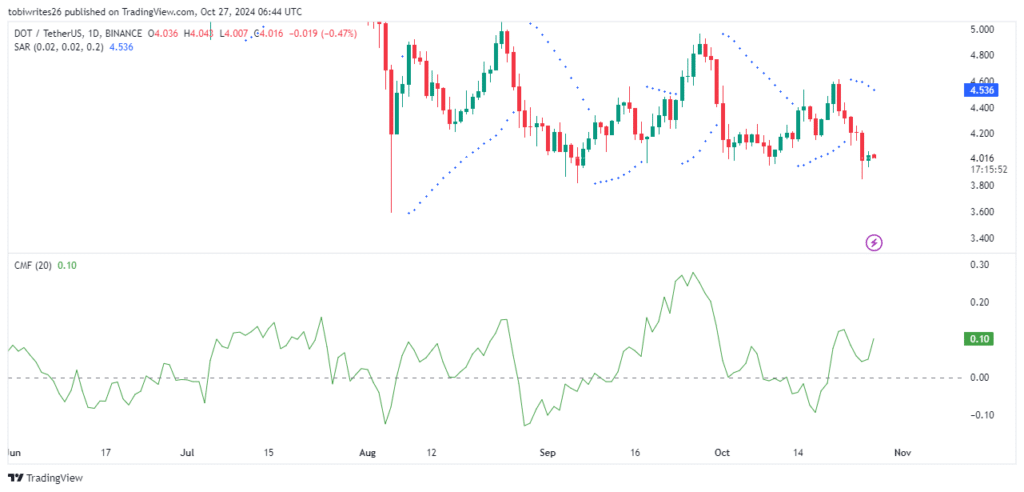

No clear pattern from traders: mixed signals for DOT

Two key indicators, Chaikin Money Flow (CMF) and Parabolic SAR (Stop and Reverse), present a mix of bullish and bearish signals for DOT, leaving its future direction uncertain.

Chaikin Money Flow (CMF), which measures the flow of liquidity into or out of an asset, showed an uptick, with a current reading of 0.11. A positive CMF value suggests increasing buying pressure, which generally aligns with potential upward price movement for DOT.

This reading indicates that if this momentum continues, the DOT could pass through its current supply zone, potentially sustaining a rally.

Conversely, the Parabolic SAR, a trend-following indicator that signals reversals, exhibits a bearish sentiment. This is indicated by multiple dots above the DOT price, indicating ongoing selling pressure and a possible continuation of the downtrend.

When the parabolic SAR points above the asset price, it signals resistance and shows the possibility of further price declines.

Source: TradingView

With these two indicators suggesting opposing trends, AMBCrypto has turned to on-chain activity to provide additional insight into DOT's next move.

There is gradual buying pressure for Polkadot

Data from Coinglass indicates a positive funds rate for DOT, suggesting an increase in long interest from traders. According to the latest reading, DOT's funding rate stands at 0.0109%

Read Polkadot's [DOT] Price Forecast 2024-25

A positive funding rate means traders with long positions pay traders with short positions to balance the price. This trend usually points to an underlying bullish sentiment, as more traders are betting on price growth, which could push the DOT higher.

If this buying pressure continues, DOT may break its current supply zone and move further to the upside.