Ethereum investors want to go long? Suspended supply rises to 29%

- Ethereum long-term storage addresses now hold 19 million ETH, nearly doubling since January 2024.

- With ETH accounting for around 29% of the total supply, reduced market liquidity may support future price stability.

Ethereum [ETH] Long-term storage was experiencing a surge, holding more than 19 million ETH at addresses as of October 18th.

This marks a significant increase from 11.5 million ETH at the start of the year, reflecting growing confidence among investors about Ethereum's long-term prospects.

Ethereum is piling up

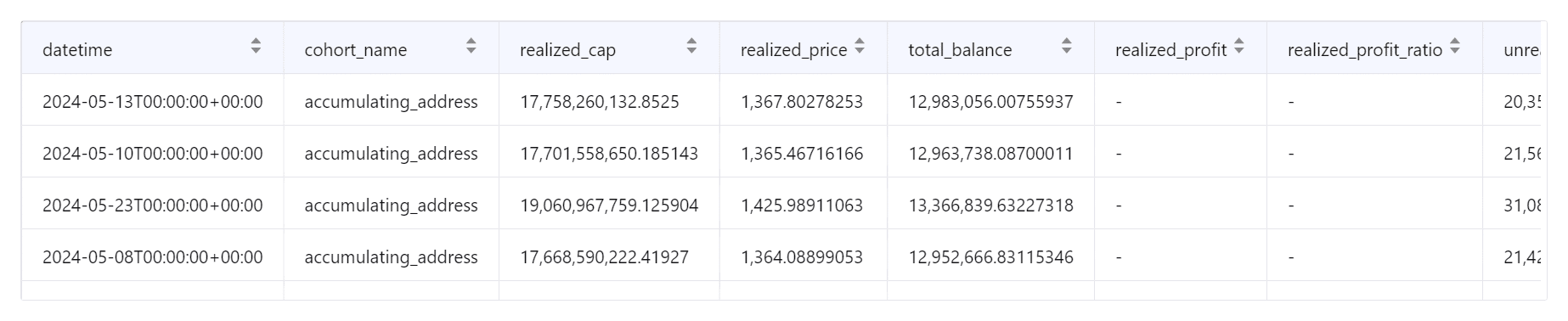

Data from CryptoQuant on the deposit address Ethereum has revealed a significant increase. In January 2024, these addresses held 11.5 million ETH, and by October this number had nearly doubled.

Experts suggest that by the end of the year, the amount held in these addresses may exceed 20 million ETH, continuing this upward trend.

Source: CryptoQuant

This increase in long-term holdings indicates that large investors and ETH supporters are building their positions in anticipation of future growth.

The approval of Spot ETFs in early 2024 has contributed to this accumulation by bringing more mainstream attention to ETH. Another driving force behind increased accumulation is the increase in ETH staking.

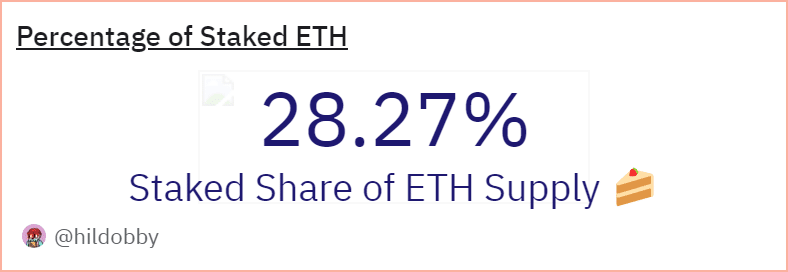

Ethereum staked close to 30% of the supply

Along with the increase in savings, staking has also become a key factor in Ethereum's market dynamics. Data from Dune Analytics shows that 34,600,896 ETH were stocked at press time, representing about 29% of the total supply of ETH.

Source: DuneAnalytics

With a significant portion of ETH now locked in contracts, selling pressure in the overall market may ease.

This could provide support for Ethereum's price in the near future, as less ETH is available for trading, which could contribute to price stability or even further price growth.

Ethereum maintains a positive trend

At press time, Ethereum was trading at $2,649, just above key support levels.

The 50-day moving average at $2,476 provided strong support, while the 200-day moving average at $3,022 served as an important resistance point.

A break above this resistance level will be essential for ETH to sustain a long-term rally.

Source: TradingView

The Relative Strength Index (RSI) sits at 61.61, indicating moderate bullish momentum without entering overbought territory.

Read about Ethereum [ETH] Price Forecast 2024-25

Meanwhile, Chaikin Money Flow (CMF) was marginally negative at -0.07, reflecting limited buying pressure but not enough to signal a bearish trend change.

While Ethereum maintains a positive outlook, breaking through the $3,022 resistance is key for a strong upward trajectory. In case of market volatility, the 50-day moving average of $2,476 could serve as important support.