ECB's Anti-Bitcoin Stance Draws Community Rage: 'True Declaration of War'

- ECB officials claim that BTC's rally will impoverish non-holders and late Assads.

- The crypto community criticized the report which called for a policy against BTC.

Over the weekend, the European Central Bank (ECB) hit the following headlines Its top executives are anti-Bitcoin [BTC] reports and calls for its 'go to'.

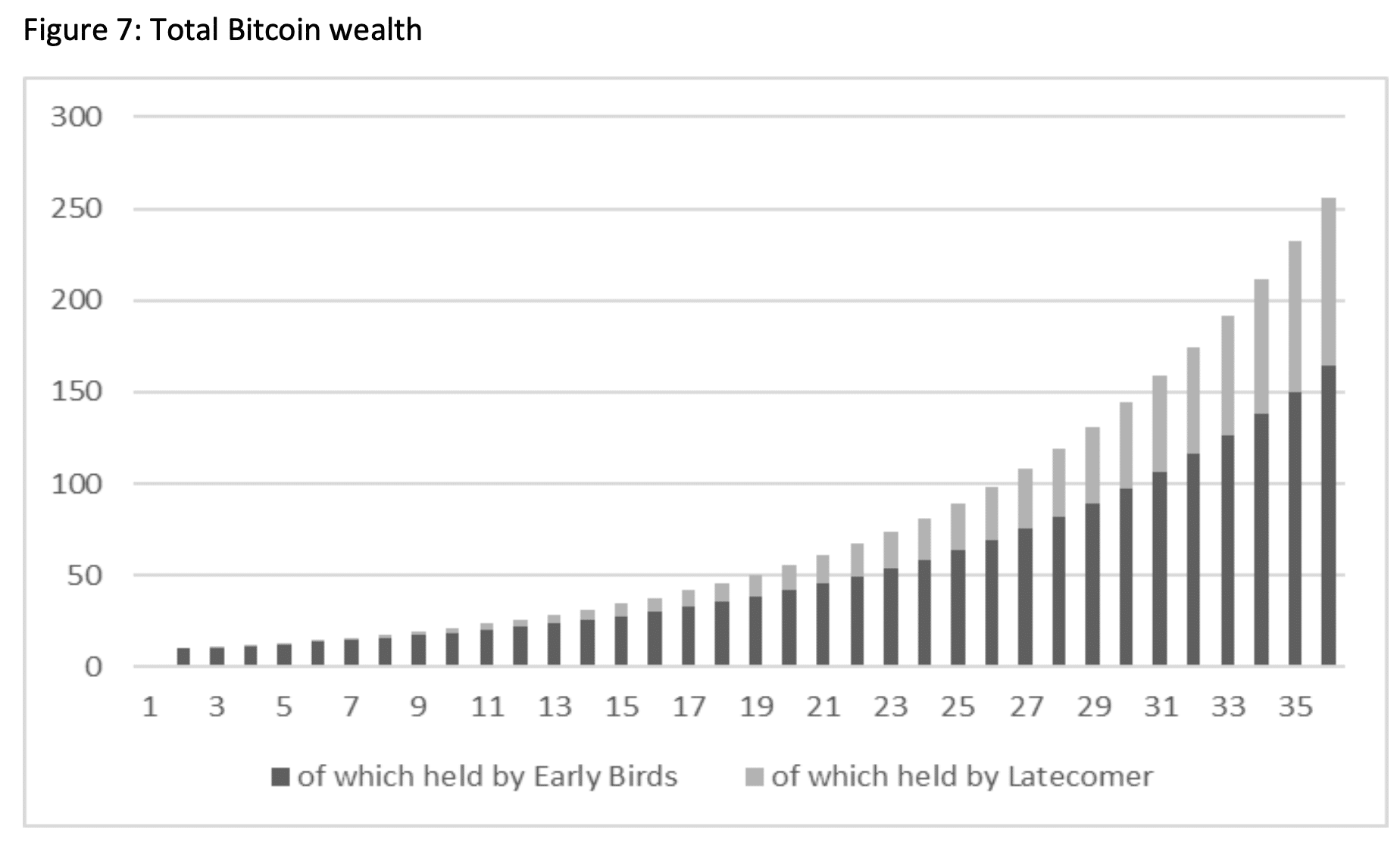

They claim that BTC price increases will lead to a redistribution of wealth from latecomers and non-holders to early adopters.

According to the report, this will impoverish latecomers and holders, as early adopters will dominate holdings and assets.

Source: SSRN

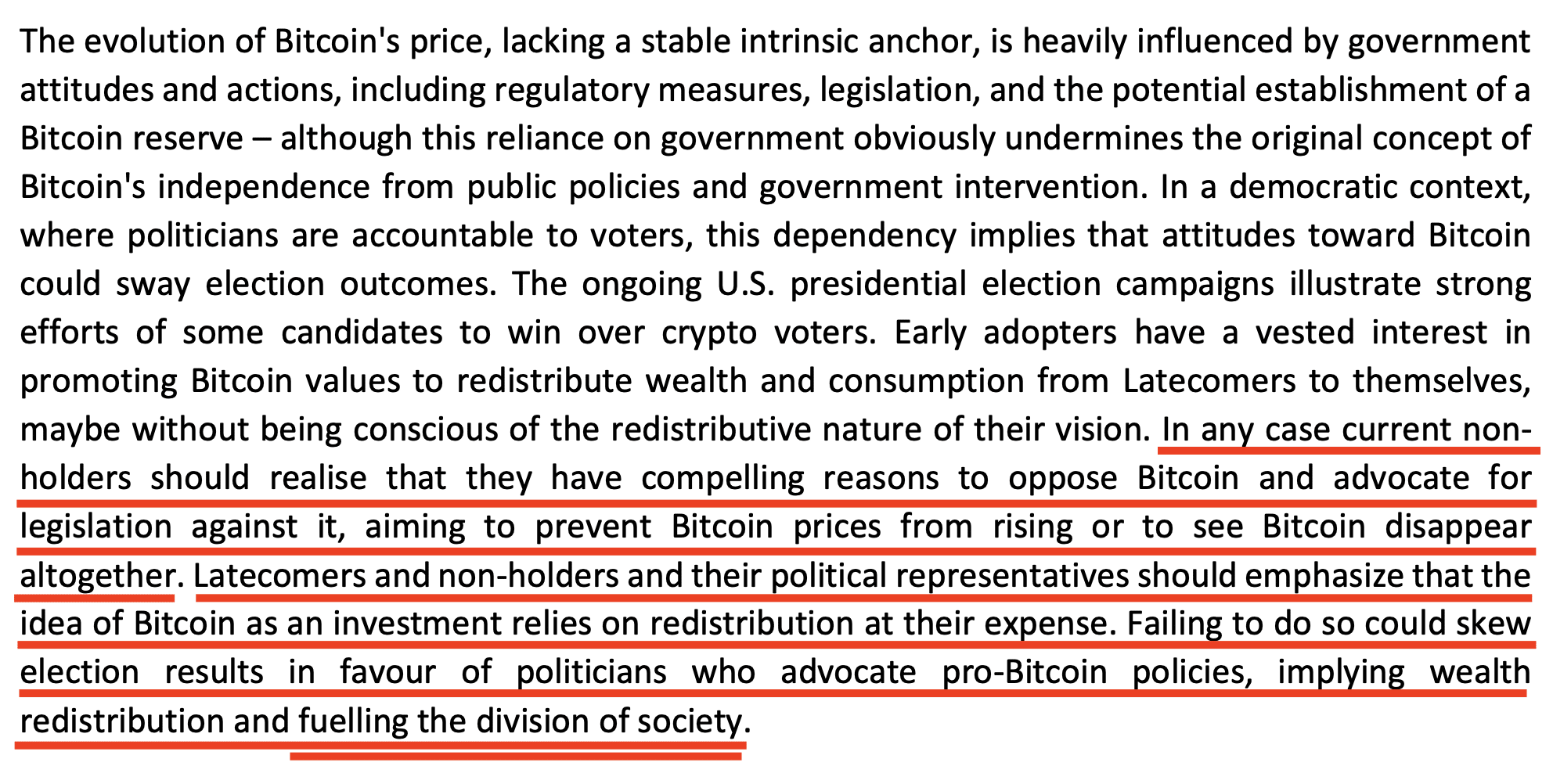

According to ECB officials Jürgen Schaff and Ulrich Bindseil, non-holders should advocate for anti-BTC policies or campaign for it to 'disappear' entirely. part of their research Reading,

“In any case, current non-holders need to understand that they have compelling reasons to oppose Bitcoin and advocate for legislation against it, with the goal of preventing Bitcoin's price from rising or Bitcoin disappearing entirely.”

Is the ECB Declaring War on BTC?

The crypto community condemned the report, while some warned that it could signal the ECB's war on BTC.

Tuur Demeester, a BTC analyst, claims that the study is the ECB's declaration of war against the digital asset. he stated,

“This new paper is a true declaration of war: ECB claims early #Bitcoin adopters steal economic value from late Assads. I strongly believe the authorities will use this ludicrous argument to impose tougher taxes or sanctions.”

Demeister cited the authors' push for legislation as one of the reasons for his projection.

“Then they brazenly advocate for legislation … “to increase the price of Bitcoin or to see Bitcoin disappear altogether” in order to prevent “divisiveness of society”.

Source: SSRN

For his part, Max Keizer, a BTC maximalist and senior advisor to El Salvador's President Naib Buquel on all things Bitcoin, mentioned ECB 'failed IQ test' on digital assets in report

“Bitcoin is an IQ test. The ECB failed.”

Well, this is not the first time the regulator has criticized BTC. In February 2024, it is stated That wealth had no intrinsic value and was a bubble that would eventually burst and cause massive social damage.

Later in June, Fabio Panetta, former ECB executive and current governor of the Bank of Italy, to call Other banks to block crypto because it is bound to fail.

In fact, even regulators criticized US moves to approve spot BTC ETF in Q1 2024.

That said, some saw the regulator's anti-BTC thesis as an acknowledgment of the asset's future explosive run.

According to Plan CA market analyst, BTC starts a global easing cycle as the controller's solution to money printing (inflation).

“There is also a hidden signal in this new ECB paper: the ECB knows for a fact that “Bitcoin will grow for good” because the ECB knows for a fact that central banks will have to start printing ungodly amounts of money soon and forever.”