Could LDO break above $1.33 resistance in key developments?

- LDO is near its $1.33 resistance, but low volatility and overbought RSI could limit gains.

- Open interest is increasing, but daily active addresses are declining, indicating potential bottlenecks ahead

Lidodao [LDO] Actively supports over 2,250 validators and secures 72,000 ETH with its simple DVT module. Additionally, the platform is currently undergoing significant upgrades, such as integrating Bolt and improving the Distributed Validator Voting (DVV) system.

At press time, LDO is trading at $1.16, up 4.24% in the last 24 hours. However, the question remains: Can these upgrades overcome LDO's key resistance level at $1.33?

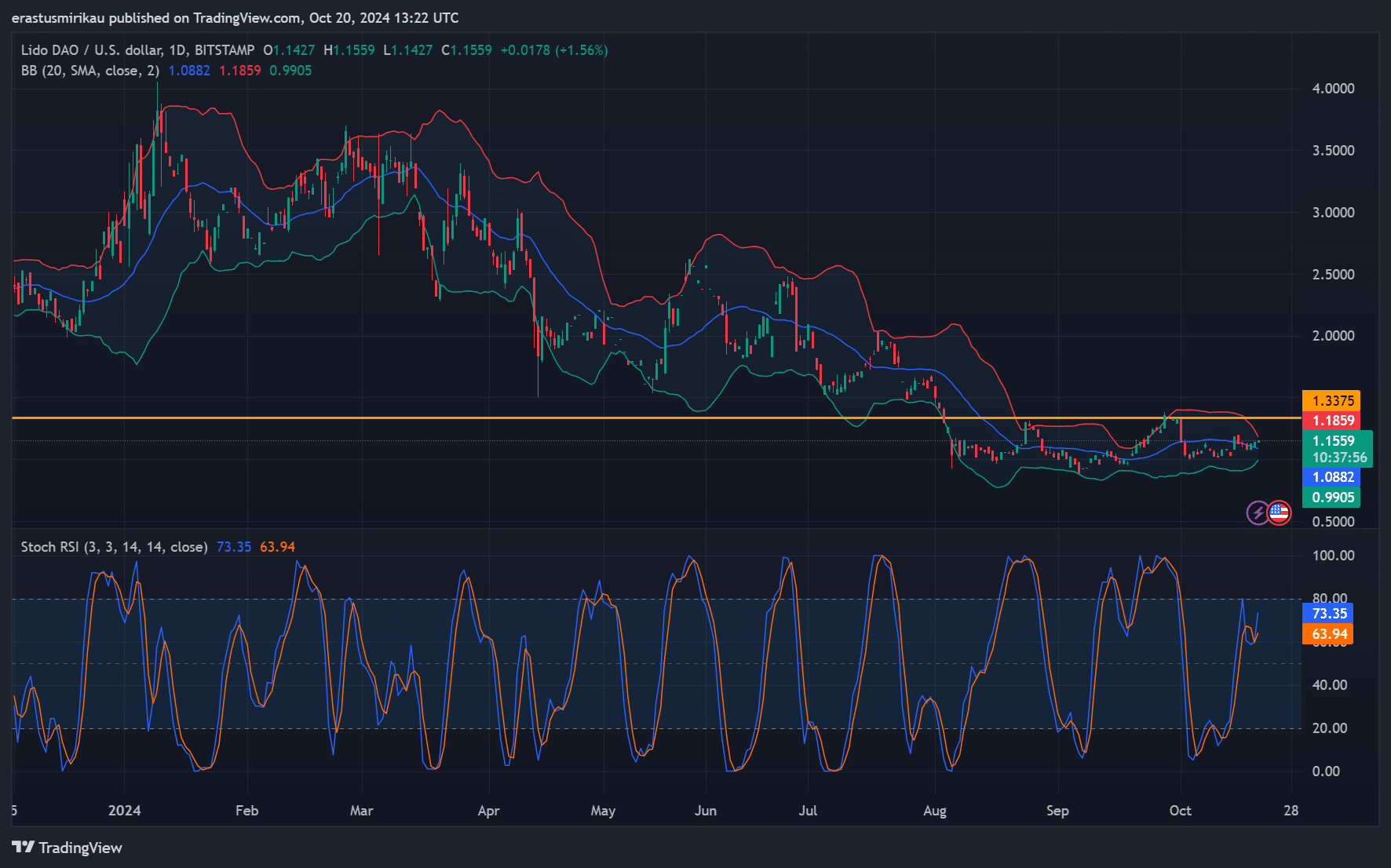

LDO Chart Analysis: Will resistance continue at $1.33?

Lido DAO reached a critical resistance level at $1.33 and recent price movements have sparked interest. Bollinger bands suggest that volatility remains low, indicating a consolidation phase.

However, the stochastic RSI points to overbought conditions, increasing the likelihood of a near-term pullback. Support is evident around $1.08, but Lido DAO will need significant bullish activity to break $1.33.

Hence, traders are watching closely to determine if this resistance will hold or if the token will gain enough momentum to move higher.

Source: TradingView

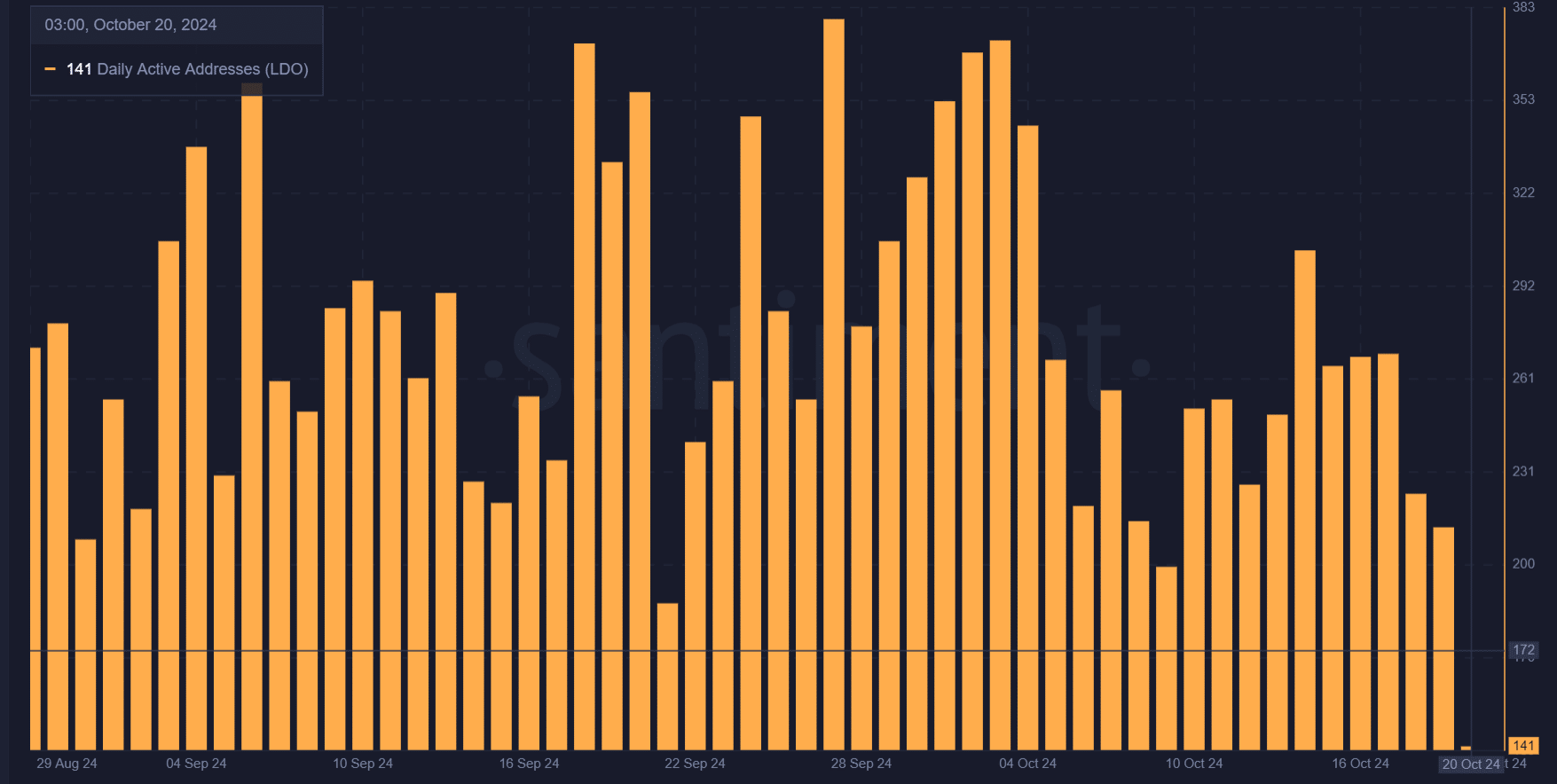

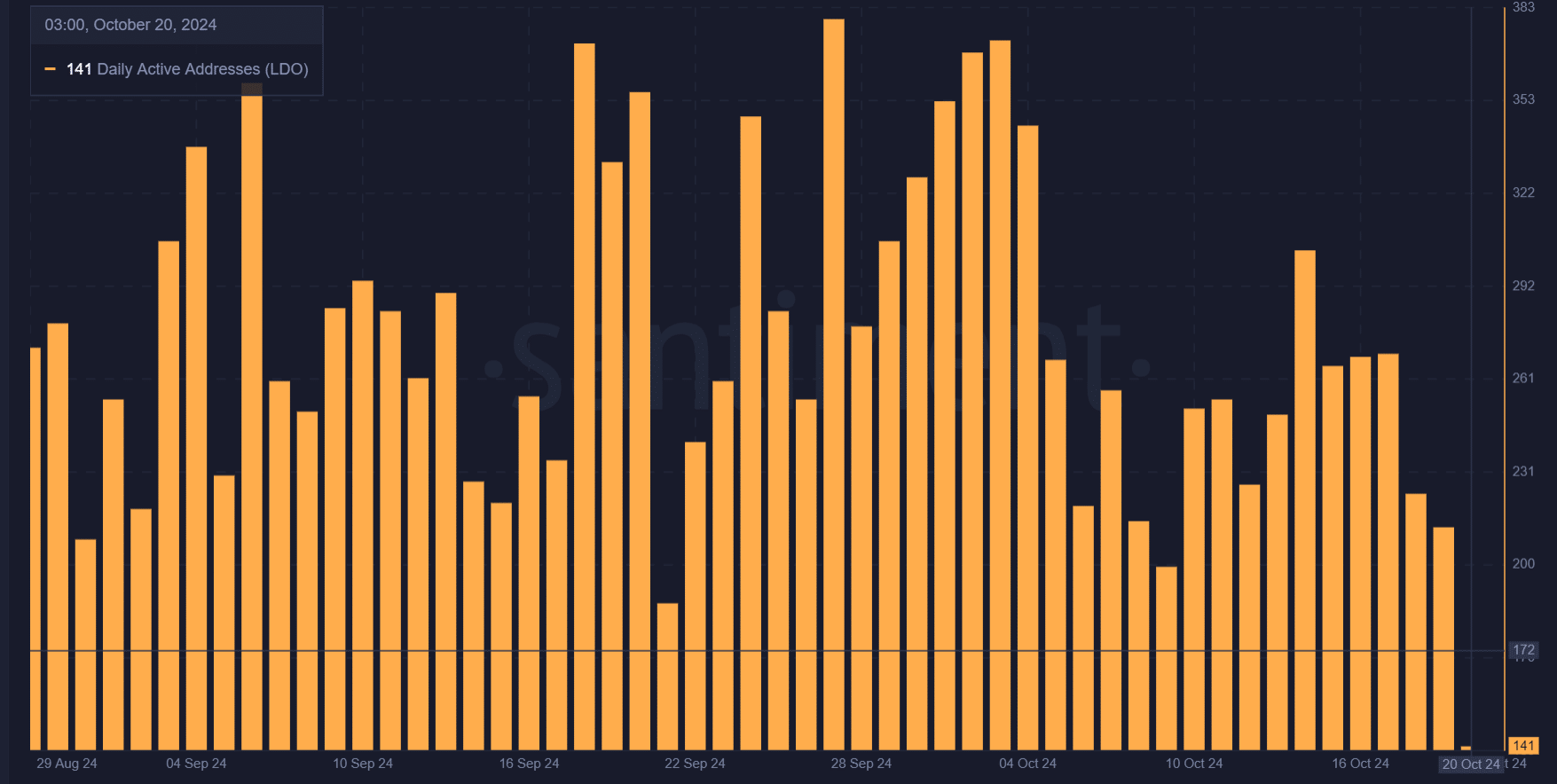

Decreased daily active address: A concern for LDO?

While Lido's technological progress is promising, the recent decline in daily active addresses is cause for concern. The number of active addresses dropped from 213 to 141, indicating a decrease in user engagement.

As a result, this could limit Lido DAO's ability to break through the $1.33 resistance as on-chain activity slows down. This decline may indicate that Lido's upgrades have yet to catch the attention of the wider market

Source: Sandhi

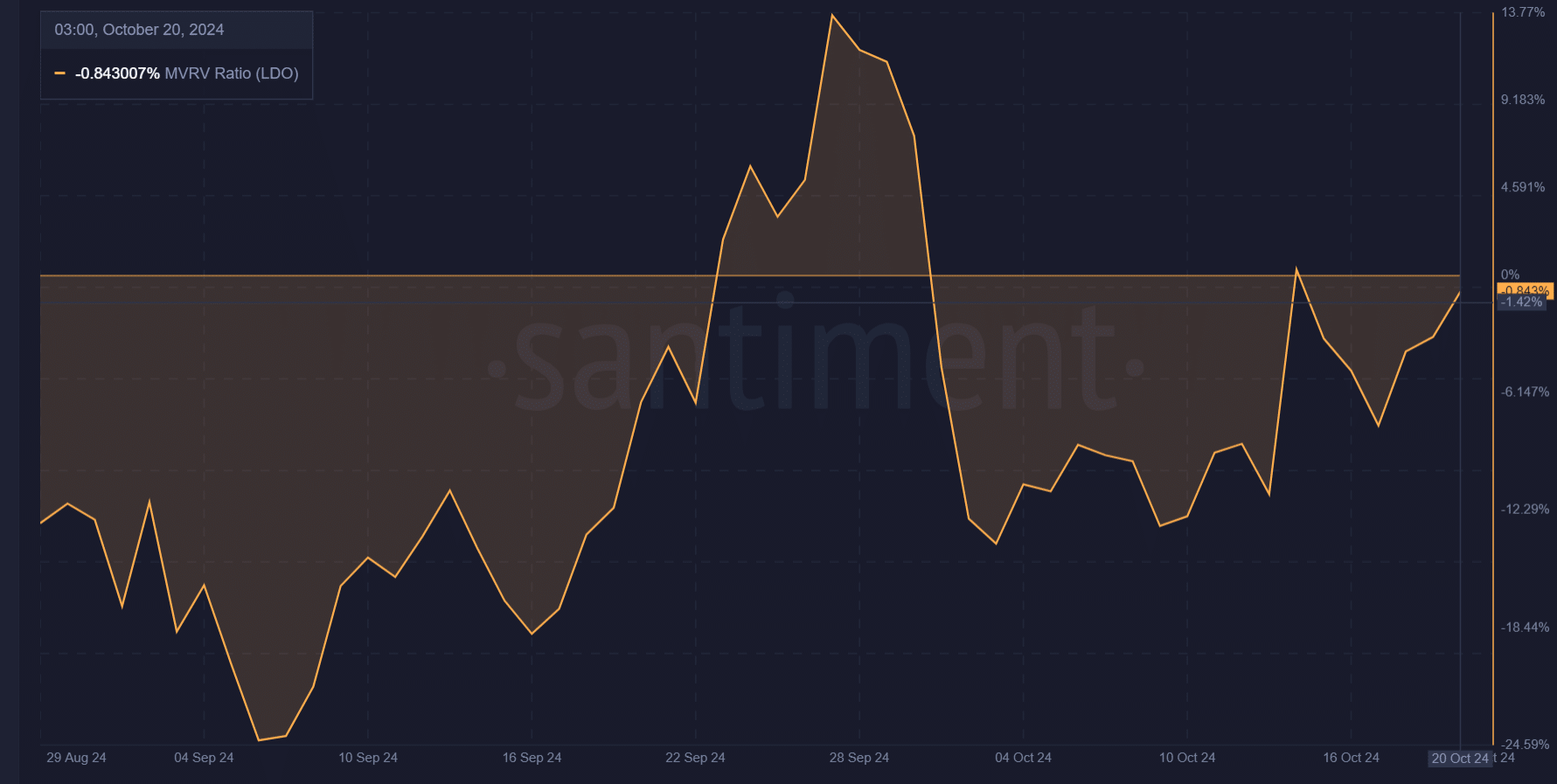

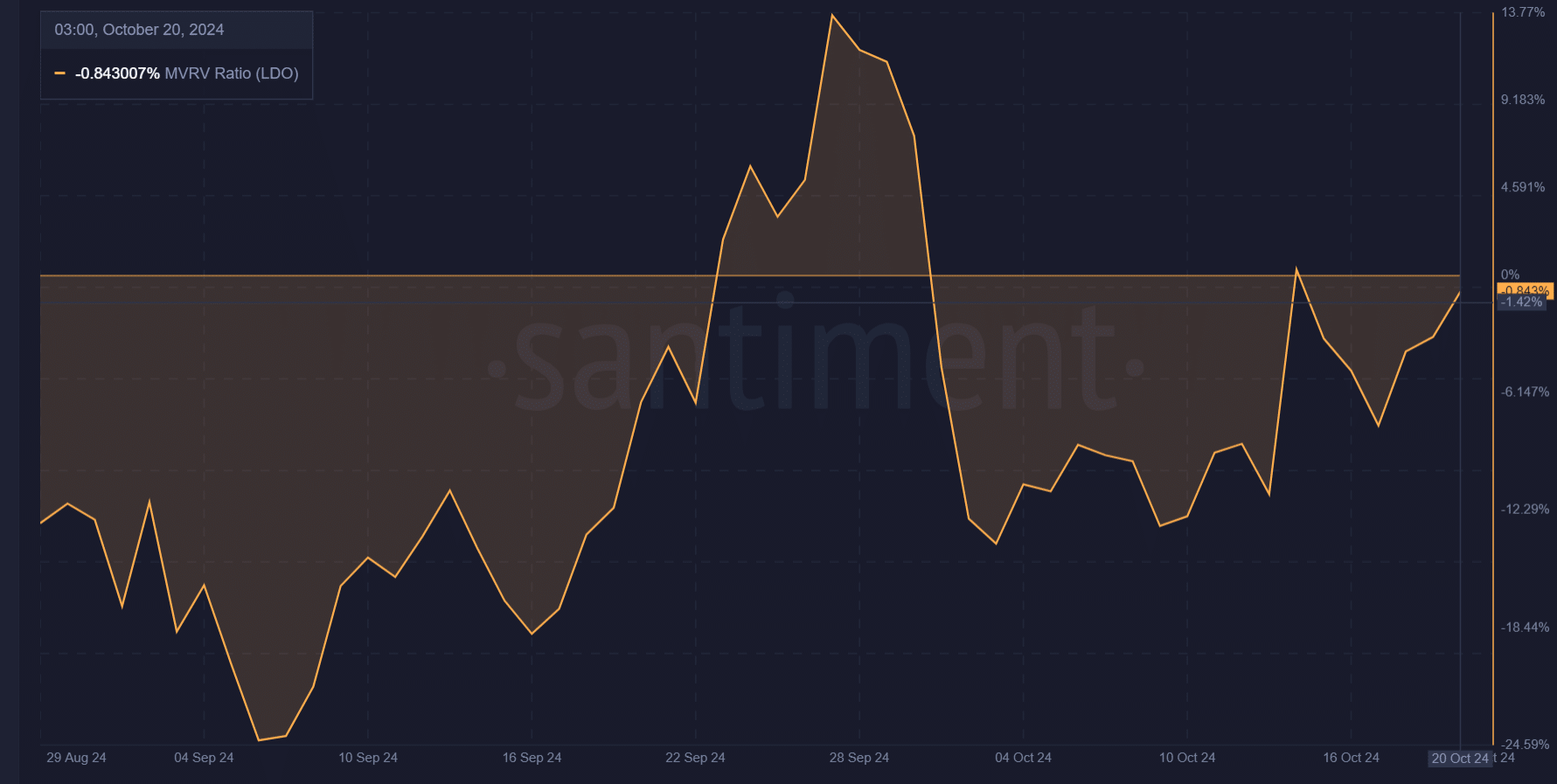

MVRV Ratio: What it stands for LDOIts worth the action?

The MVRV ratio, which currently stands at -0.84%, reveals that most of the investors are losing LDO. Therefore, holders may have less incentive to sell, potentially supporting prices in the short term.

However, if the MVRV ratio turns positive, profit taking may increase, putting downward pressure on the token. This dynamic makes the MVRV ratio an important factor in determining whether LDO can maintain its upward momentum and challenge the $1.33 resistance.

Source: Sandhi

Open interest rises: Traders' confidence rises

Open interest for Lido DAO rose 1.98% to $64.9 million. This increase indicates growing confidence among traders, as more positions are being opened.

However, for this to translate into a bullish breakout, volume must follow. Consequently, this increase in open interest will be closely watched to see if it drives LDO to a breakout or another rejection at $1.33.

Source: Coyonglas

Read about Lido DAO [LDO] Price Forecast 2023-24

Developments in Lido DAO are promising, but declining daily active addresses and overbought Stochastic RSI are current challenges.

While rising open interest and the MVRV ratio offer some optimism, sustained engagement and volume will be needed to break through the $1.33 resistance.