Bitcoin: The Psychology Behind BTC's Boom And Why It's Calling $73K

- Bitcoin was experiencing a psychological upswing, making an unlikely correction for now.

- However, when fundamentals finally take over, panic can set in.

The risk of market overheating is increasing because of Bitcoin [BTC] Crossing the $68K benchmark, breaking a four-month slump, even as the RSI sees a sharp decline.

As a result, trading just above this critical level could signal a potential top for BTC. If this range is confirmed as a resistance point, a price correction may be on the horizon, potentially forcing mass capitulation. however,

Bitcoin Wave – Psychology on the Fundamentals

First, it is essential to consider that Bitcoin is heavily influenced by macroeconomic factors.

Currently, a confluence of events – such as the post-halving surge, the near end of the election cycle, the “Uptober” frenzy, and the Fed rate cut – has driven Bitcoin to pullback to $68K in just ten days with no tightening.

This is important because, despite key technicals pointing to near-term upside, these macro factors could reinforce large holders' belief that this is a key buy zone.

In other words, the big players may still see this level as an opportunity, and this psychological momentum may attract more buyers, as FOMO increases as market sentiment heats up.

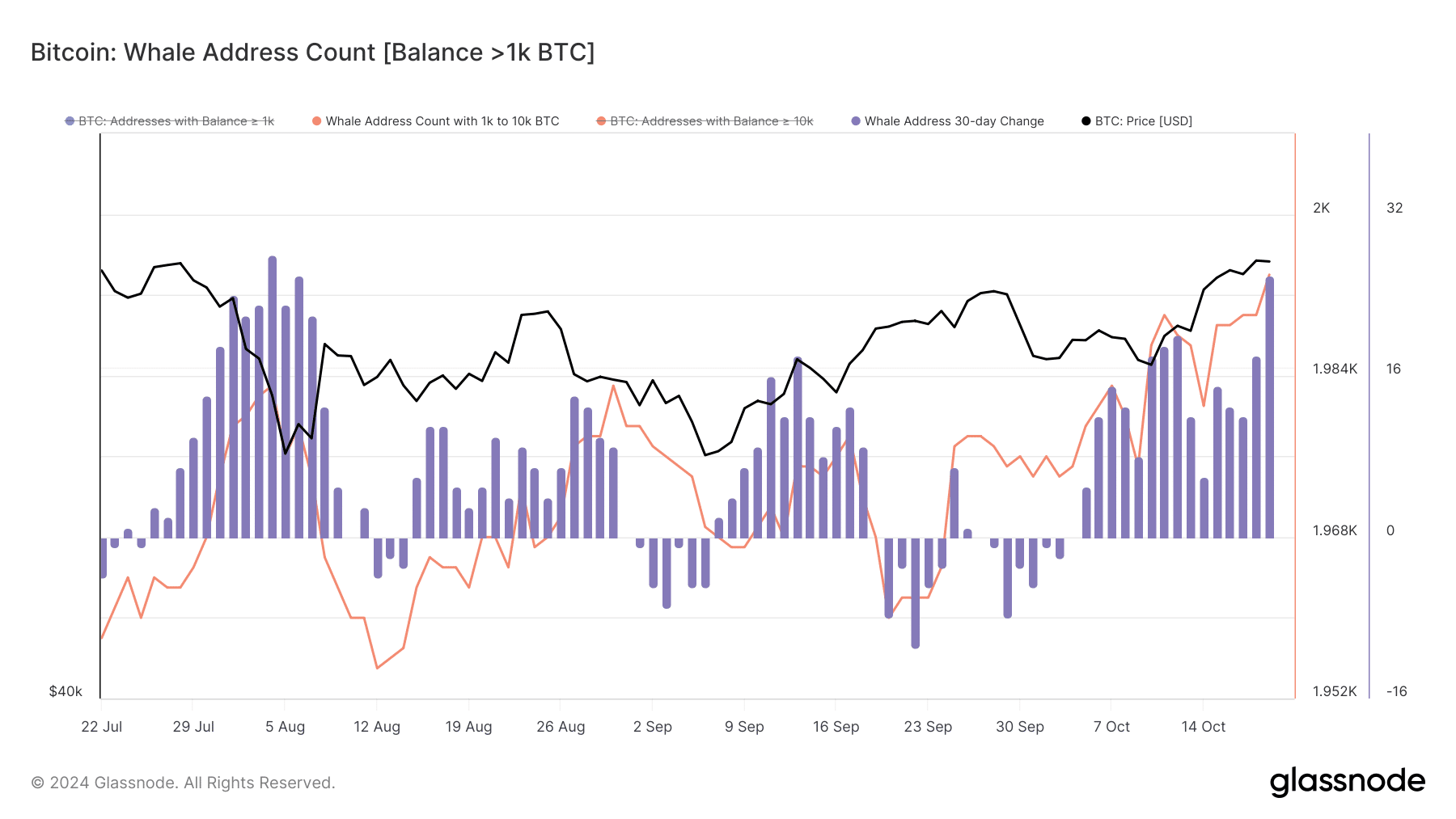

Source: Glassnode

A surge in whaling activity supports this: addresses holding 1K–10K BTC hit 3-month highs. The latest major spike occurred alongside a 5% daily price increase, pushing BTC above $66K.

Simply put, whales have played a key role in countering bearish pressure. Since early October, their activity has reinforced AMBCrypto's initial hypothesis: macro factors are drawing in the big players.

Overall, this cycle seems psychologically driven. So, despite bearish efforts to short Bitcoin, the chances of a significant correction seem slim for now.

Market buzz is leading to $73K

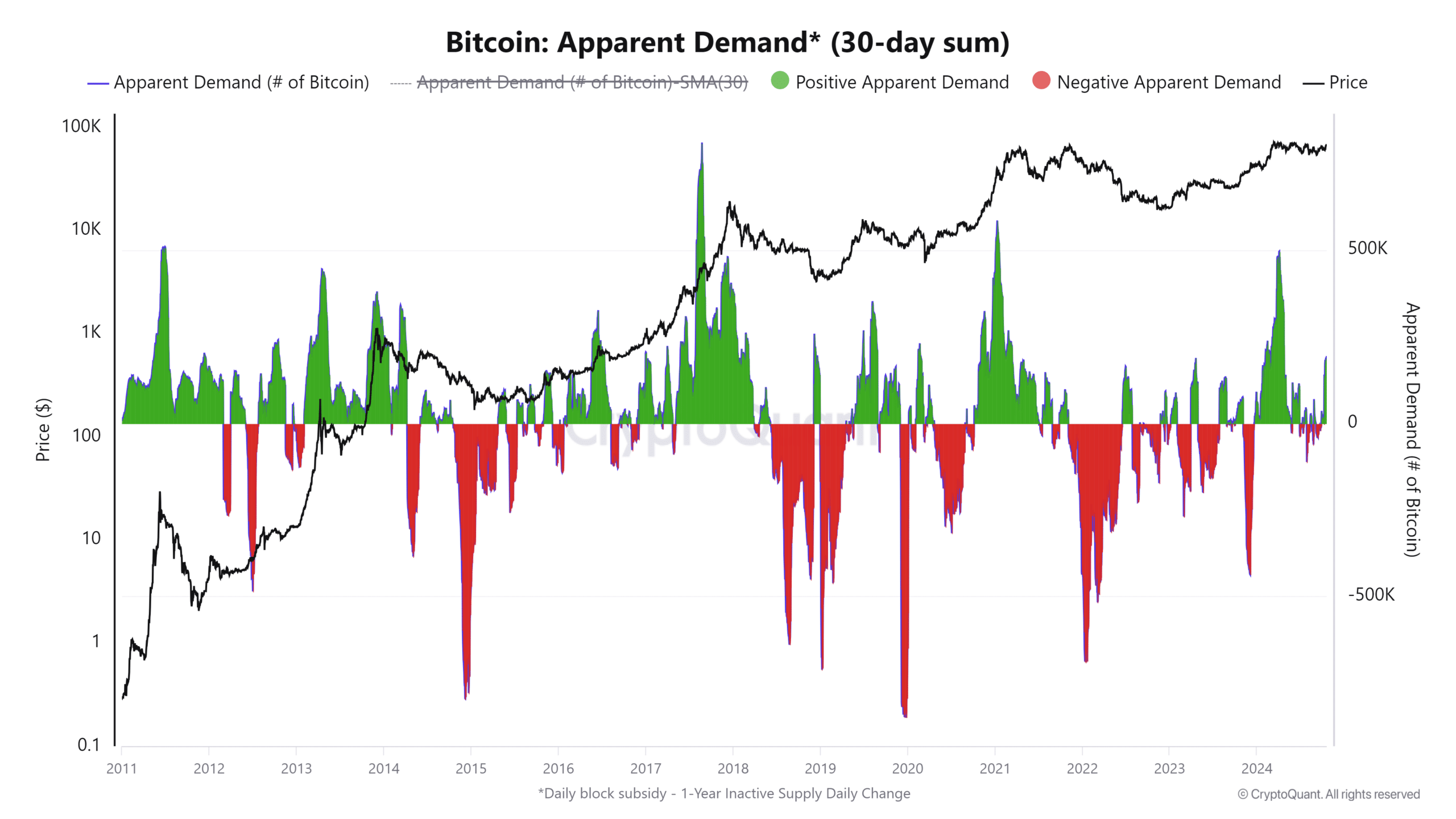

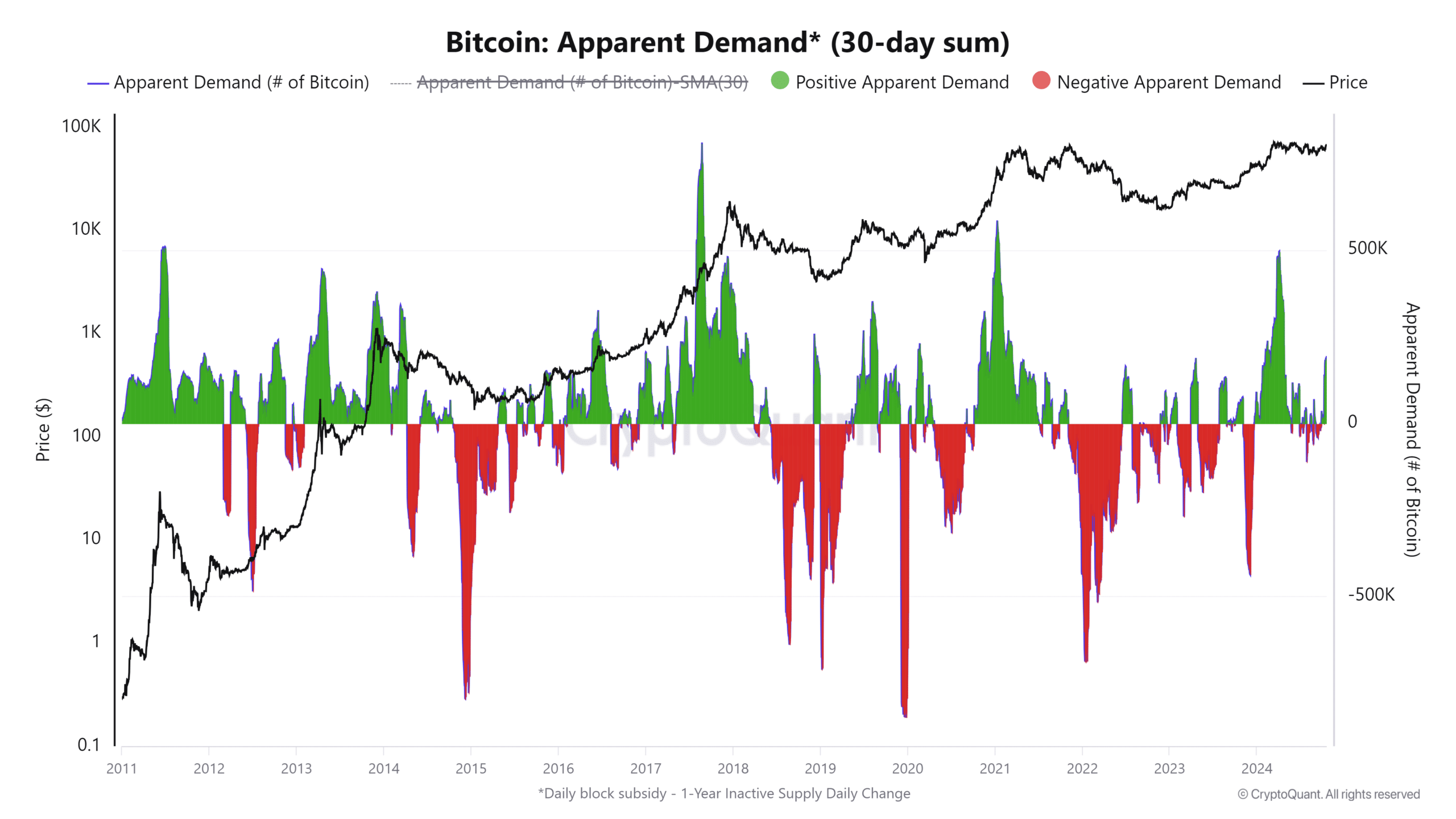

Historically, half a year has been a reliable indicator of when a bull cycle might occur. Spikes in the 30-day average demand (marked in green) have consistently coincided with decreases in Bitcoin's supply.

These supply reductions usually give rise to long-term rallies, which provide large returns to stakeholders.

Source: CryptoQuant

Interestingly, even if the fundamentals don't play out immediately, only massive expectations can trigger a breakout.

Is your portfolio green? Check out the BTC Profit Calculator

This cycle is a prime example: the market buzzed in anticipation of a halved rally, and true to form, Bitcoin rose to $68K in a remarkably short period of time.

That said, if whale activity continues on this upward trend—which is likely—Bitcoin could hit its all-time high of $73K before the end of Q4.