Bitcoin Buying Pressure Increases: Will BTC Fall Again To $66k?

- The buying pressure on Bitcoin was high.

- Market indicators suggest a price correction in the coming days.

After a cruise, Bitcoin [BTC] The last few hours have witnessed a correction. A recent report also pointed to a development that indicates a price correction.

AMBCrypto plans to examine BTC's on-chain data to see if this correction will last or if the trend will change again.

How is Bitcoin doing?

Bitcoin has lost its bullish momentum. According to CoinMarketCapKing Coin has gained more than 8 percent in the past seven days.

However, the trend has changed in the last 24 hours, as the coin price has changed little. At the time of writing, the coin was trading at $68,423.71 with a market capitalization of over $1.35 trillion.

Meanwhile, Ali, a popular crypto analyst, recently posted one Tweet Revealing an important development. According to the tweet, Bitcoin's main indicator, the TD Sequential flagged a sell signal.

This indicates that investors may start selling the currency. Whenever selling pressure increases on an asset, it signals a bearish price.

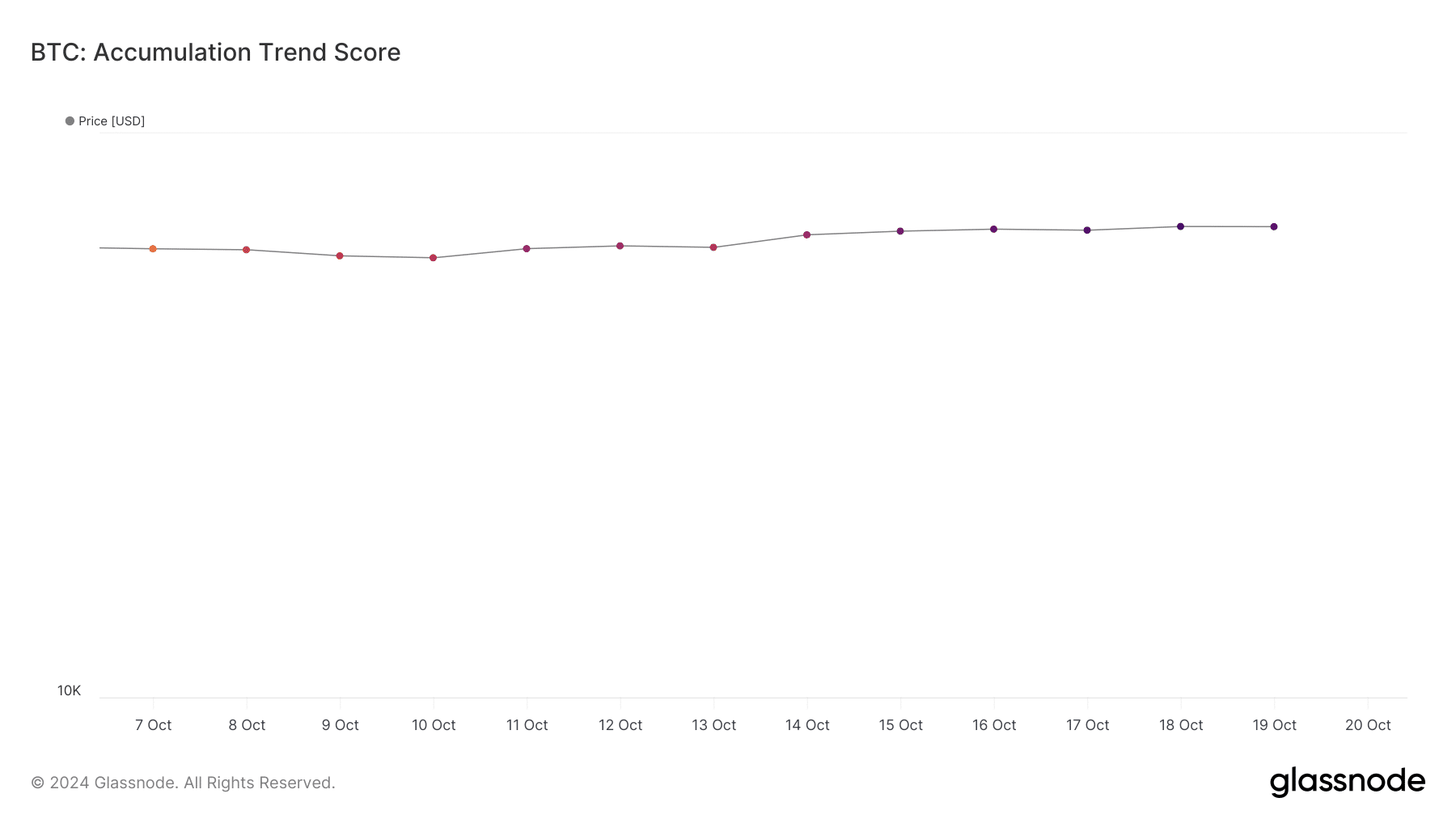

However, according to our analysis of Glassnode's data, investors started buying more BTC. It revealed that BTC's Savings Propensity Score increased from 0.5 to 0.7 last week.

For starters, the Accumulation Propensity Score is an indicator that reflects the relative size of entities that are actively accumulating coins on the chain in terms of their BTC holdings.

A number closer to 1 represents increasing buying pressure.

Source: Glassnode

Is BTC ready for a correction?

AMBCrypto digs deeper to find out what to expect from King Coin in the coming days. According to our analysis, Bitcoin's NVT ratio has increased over the past few days.

Whenever the metric increases, it indicates that an asset is overvalued, indicating a decline in value in the coming days.

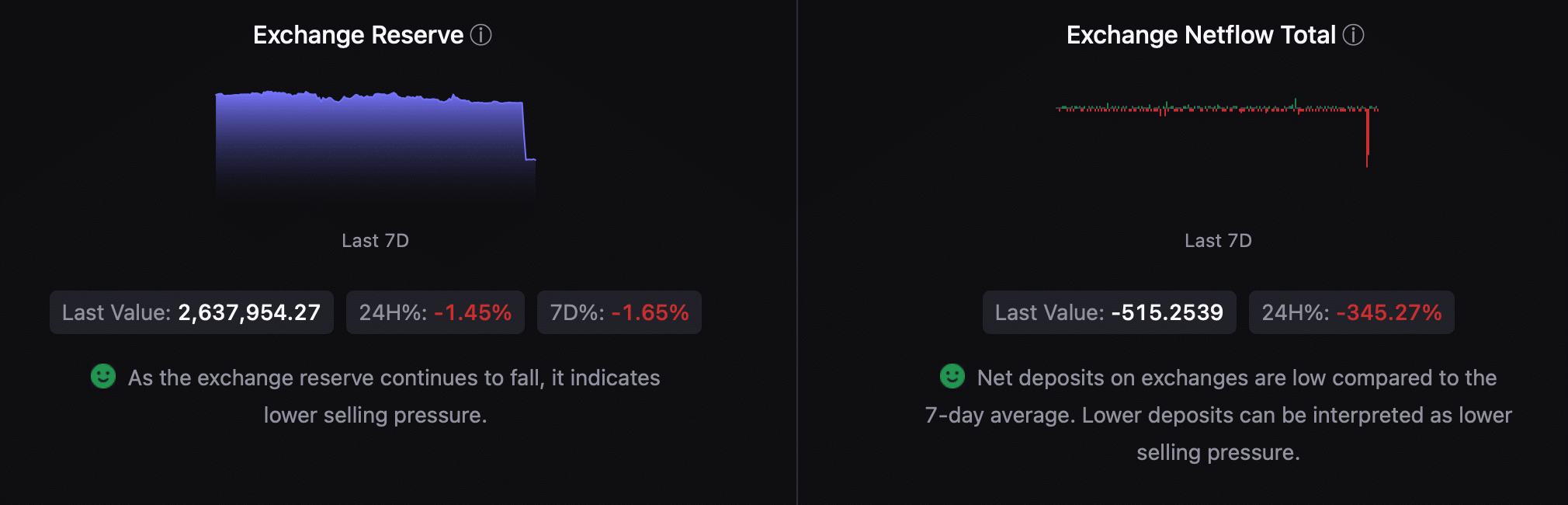

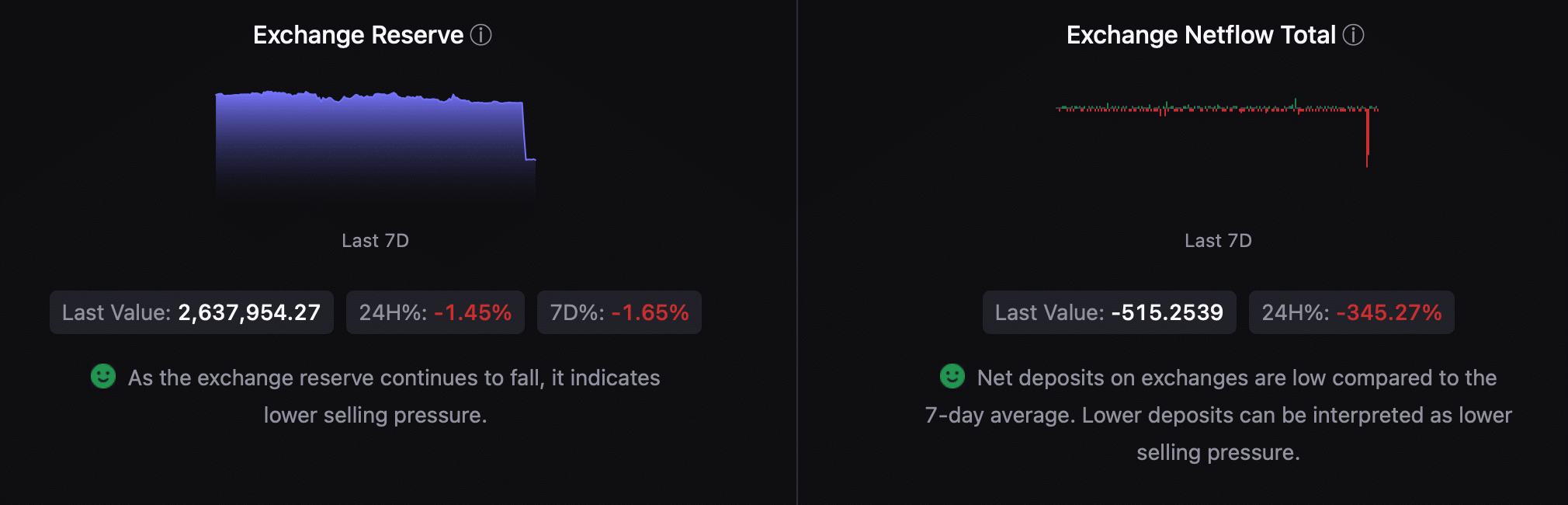

However, BTC's exchange reserves were decreasing, which meant that the selling pressure decreased. That investors were still buying BTC was further evidenced by its net deposits on exchanges.

Specifically, net deposits of Bitcoin on exchanges were lower than the average of the past seven days. Both of these metrics were bullish, as higher buying pressure pushed prices higher.

Source: CryptoQuant

read on Bitcoin (BTC) price forecast 2024-25

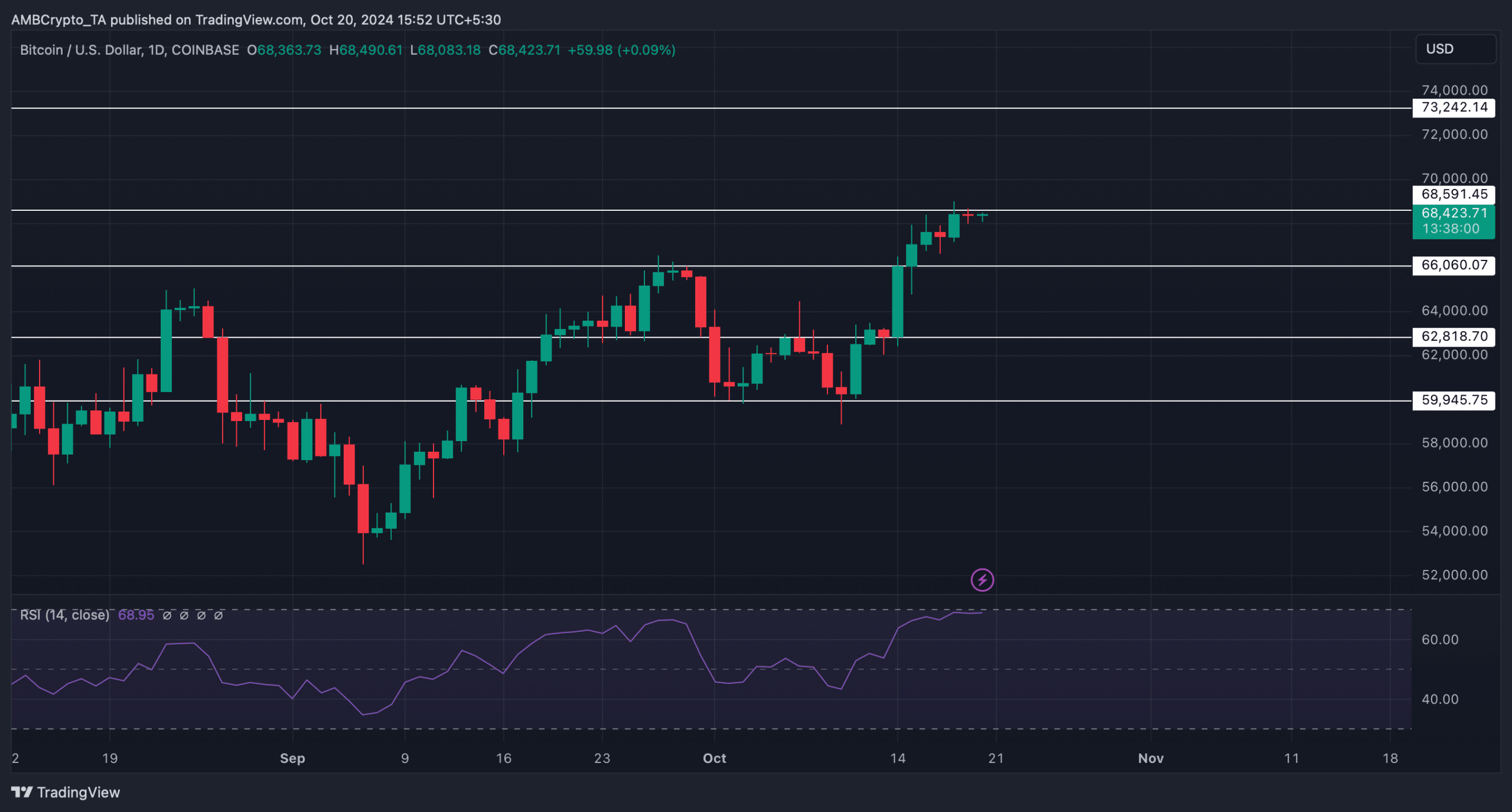

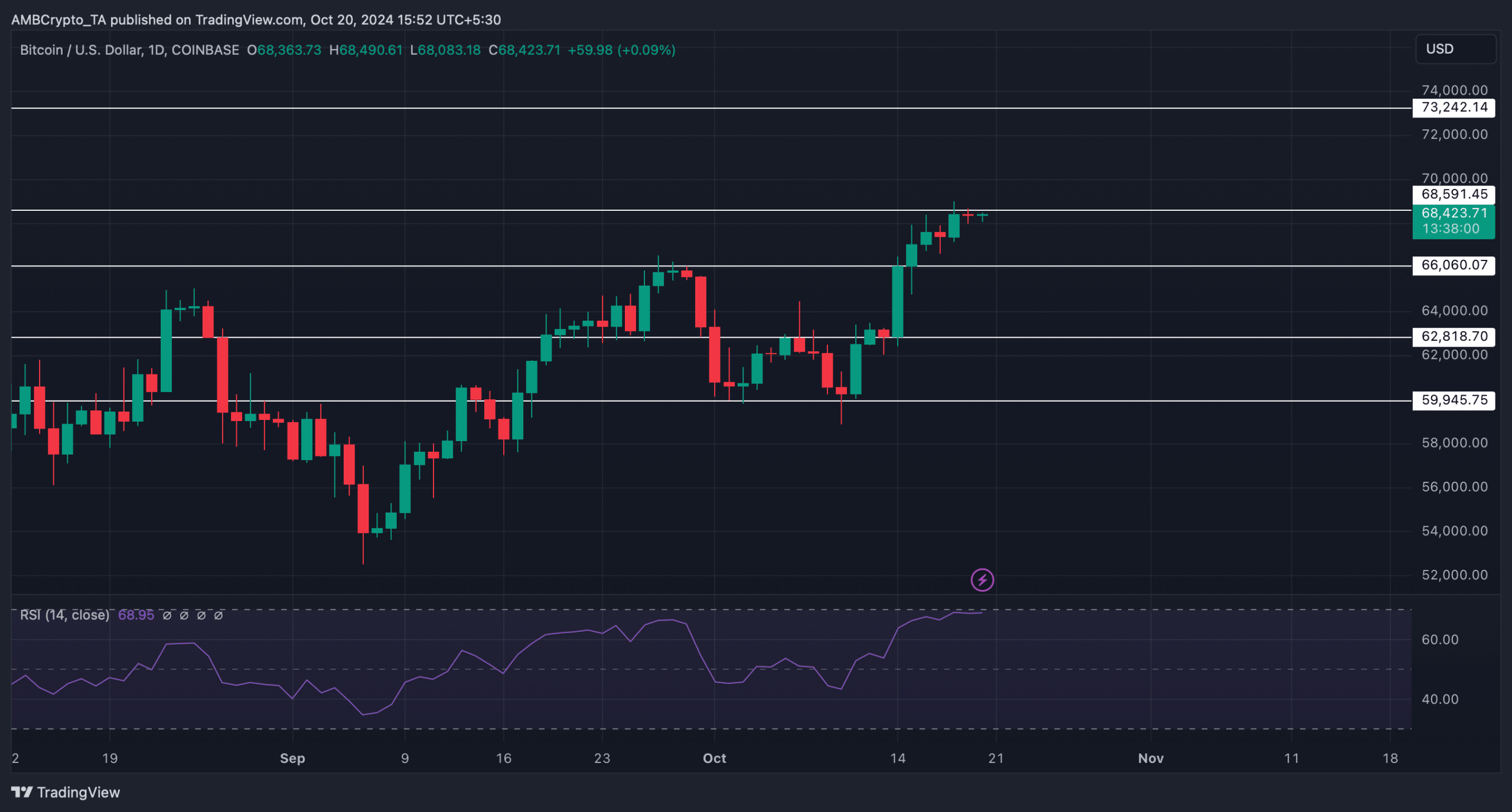

AMBCrypto then checks the daily chart of Bitcoin to see what to expect. We see BTC getting rejected at its resistance. Notably, its Relative Strength Index (RSI) is entering the overbought zone.

If that happens, Bitcoin may witness a price correction, causing BTC to drop back down to $66k. In case of continued bull run, BTC could touch $73k.

Source: TradingView