Bitcoin: Analyst Predicts $75K-$80K Rise: Here's Why

- Analyst predicts possible BTC breakout and rally towards $75K-$80K.

- Investor demand supported the recovery outlook, but increasing leverage could be risky.

Bitcoin [BTC] Price charts indicate a possible market structure change, indicating a potential breakout from the $50K-$72K price range that began in March.

According to the analyst Stockmoney LizardA range breakout can occur within two weeks. If so, the analyst predicts that BTC could hit $75K-$80K if the recent drop below $60K is defended as a 'higher low'.

“If this higher low is confirmed, we will break this upper resistance in 2 weeks. $75-$80k is the next goal.”

Source: Stockmoney Lizards

For context, BTC has been on higher lows since August, a price action trend that indicates a potential market structure change, especially if higher highs lie ahead.

Increasing demand versus risk

Investor appetite for the world's largest digital asset also improved, suggesting a slower but steady demand recovery in Q4 compared to Q2/Q3.

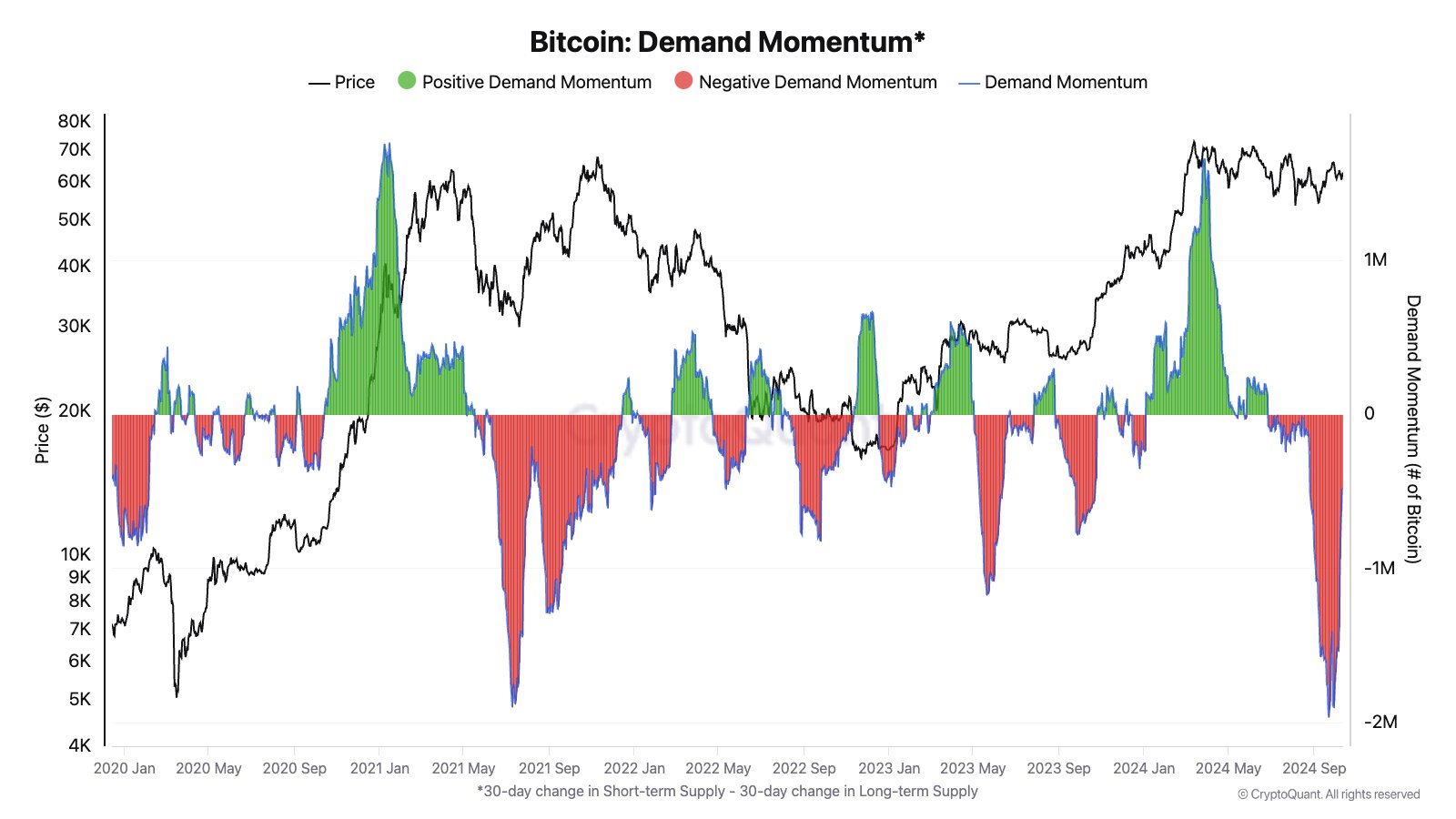

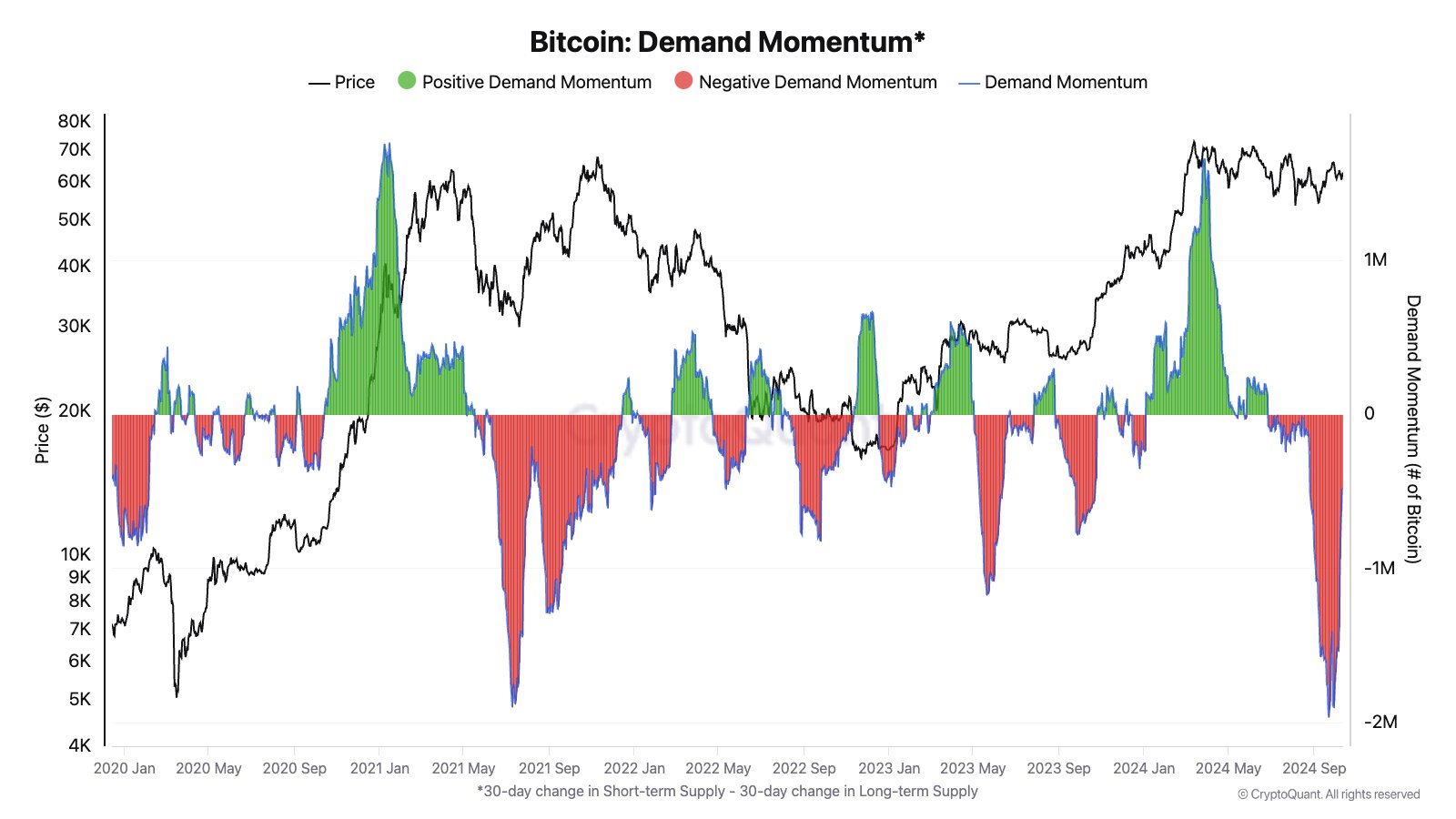

For perspective, BTC demand has been negative since May, with buying outsold. However, CryptoQuant noted that the momentum of the imbalance has slowed.

Source: CryptoQuant

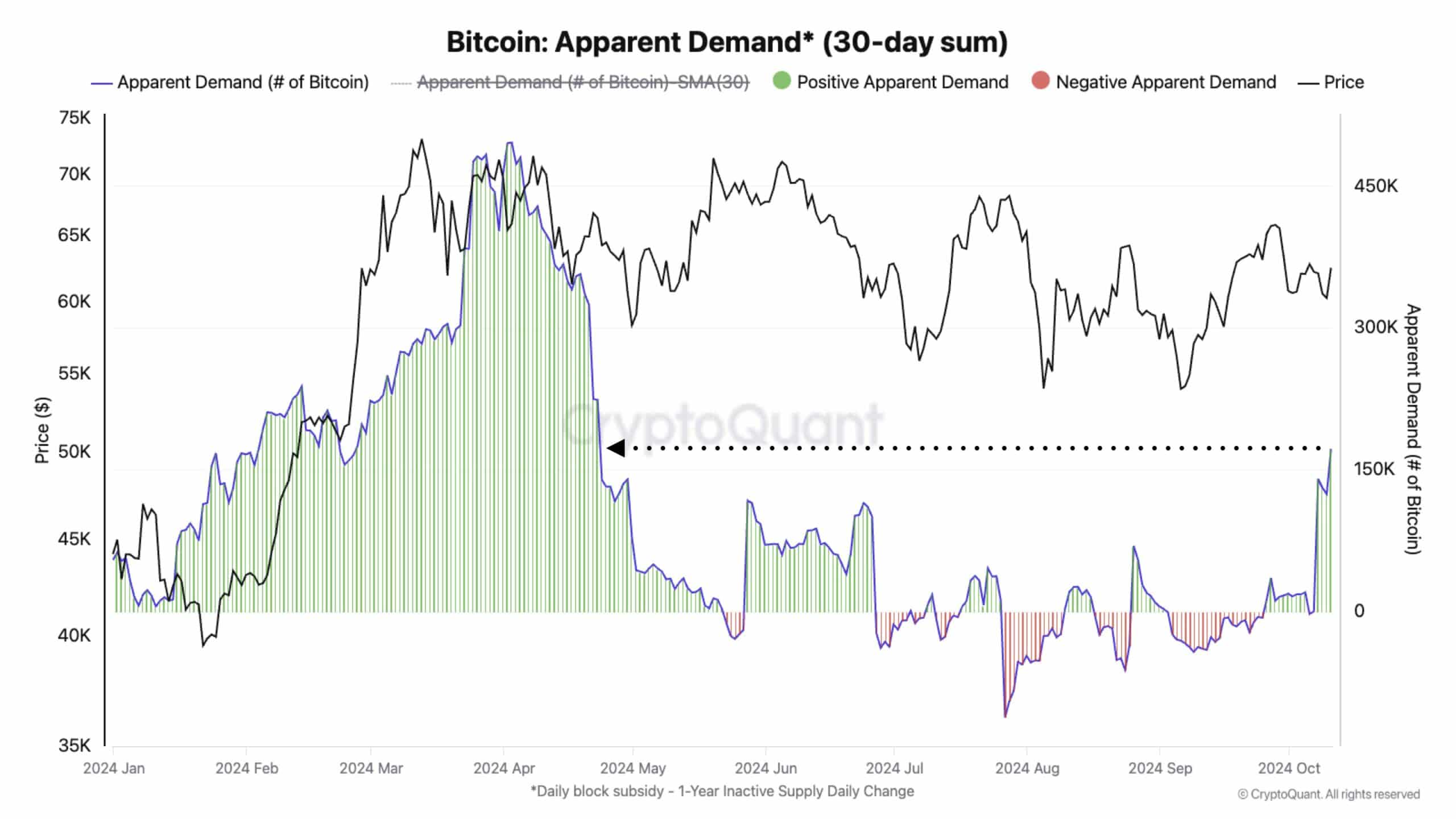

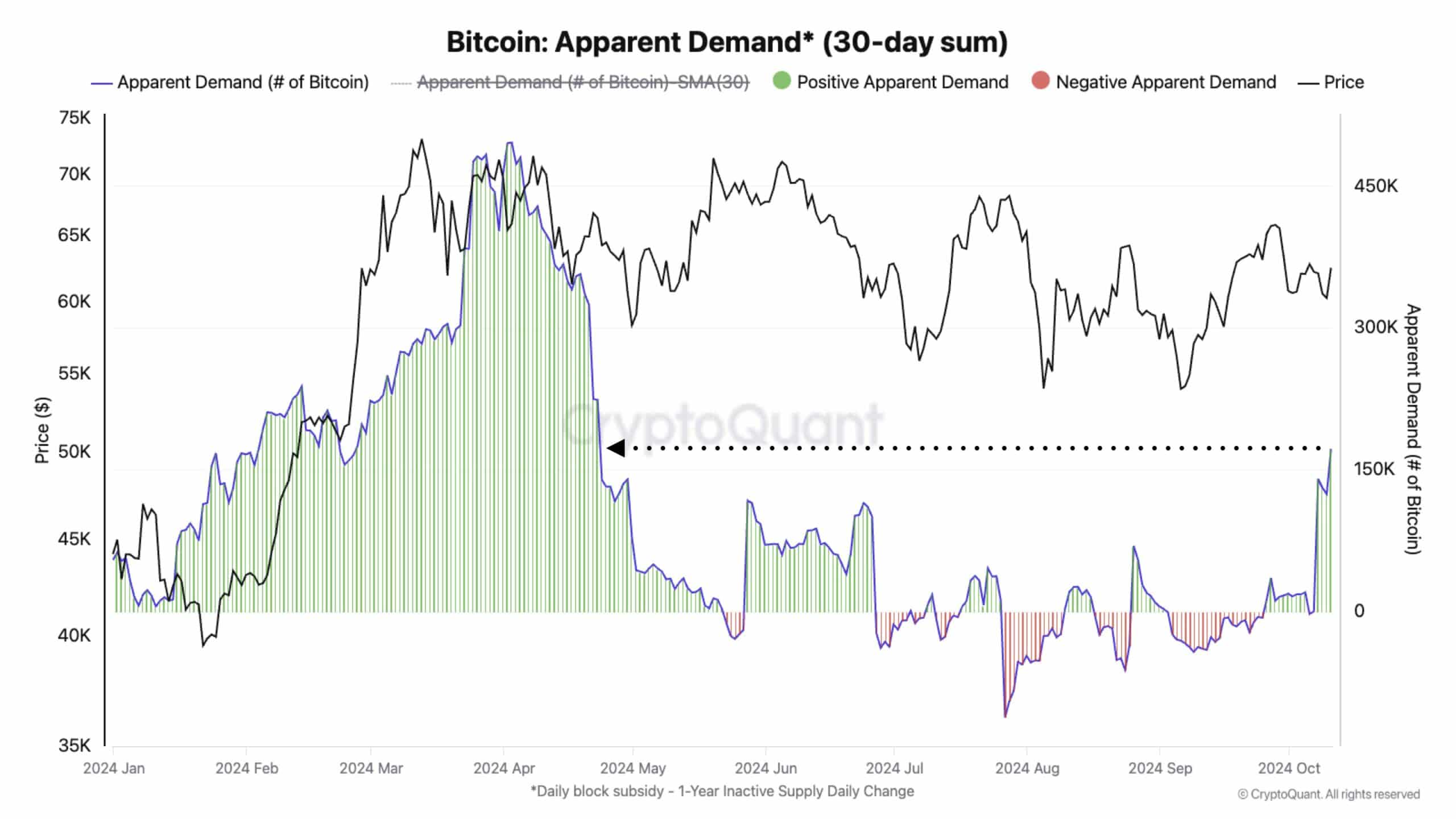

In fact, apparent demand for BTC has been measured over the past 30 trading days, indicating that investor demand was last seen in May.

About 150K BTC, worth about $9.4 billion, were snapped up by investors between late September and mid-October.

Source: CryptoQuant

Therefore, if the pattern extends over the next two weeks, rising demand could support Stockmoney Lizards' breakout projection.

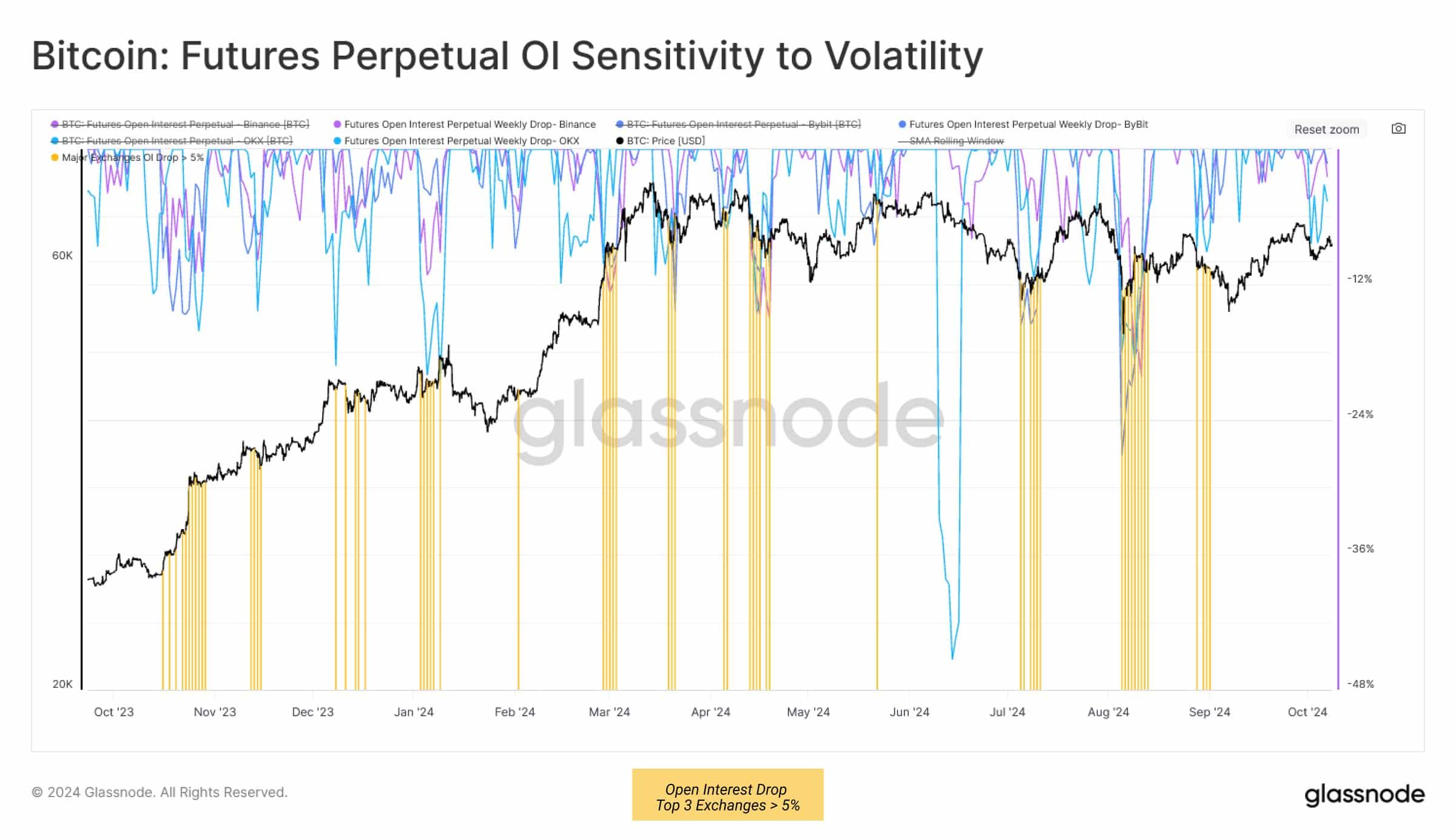

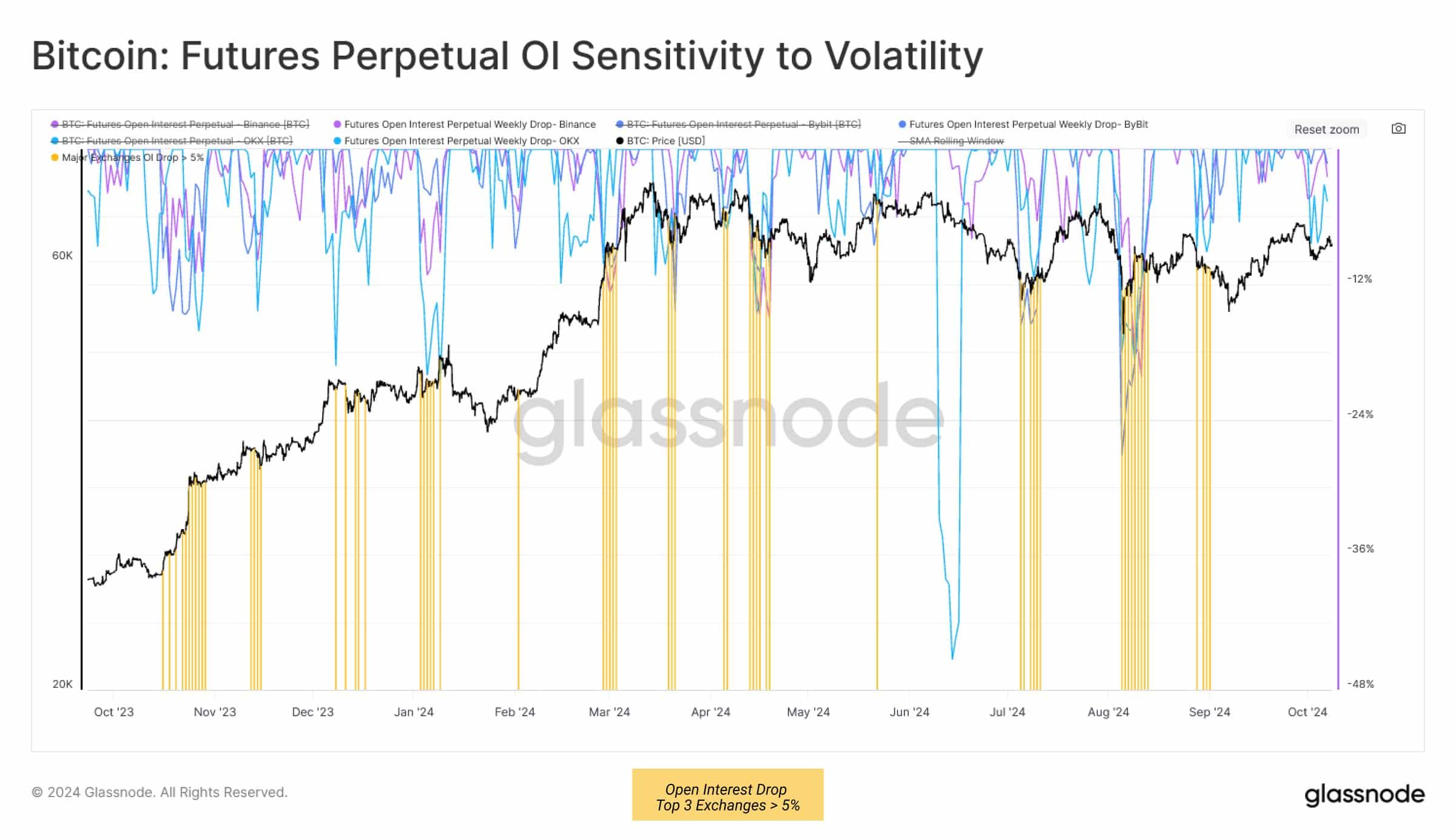

But increasing leverage, as marked by a rise in open interest (OI), also poses an imminent problem for breakout expectations.

For the uninitiated, increased leverage means speculators are taking on more risk by borrowing money to open BTC positions in the futures market.

According to Glassnode, the recent weekend pumped from $58.9K to $63.4K, flushing some short-sellers ($2.5B in OI).

Source: Glassnode

However, the analyst firm also noted that the drop in OI did not exceed 5%, a level that historically has always seen an extended BTC rally when hit.

In short, higher volatility and liquidation risk on either side of the price direction can derail breakout expectations.

Meanwhile, BTC was valued at $62.8K and consolidated below the 200-day moving average (MA) at press time.