EV sales in Q3 were another record-breaking quarter: Here's why

It's been widely reported that electric vehicle (EV) sales growth has slowed this year, but new third-quarter data shows continued growth in the sector, supported by incentive programs and a wider variety of options available to consumers this year than last year. something

According to Kelly Blue Book estimates reported by Cox Automotive in a press release last week, EV sales in the U.S. rose 11 percent year-over-year in Q3 – hitting record highs in both overall market share and total delivery volume.

Total EV sales reached 346,309 in the third quarter, a 5-percent jump from Q2. Meanwhile, total EV market share reached 8.9 percent in Q3, the highest level ever recorded and jumping from 7.8 percent in the same quarter last year.

“Although growth has slowed year-over-year, EV sales in the US continue to be high,” said Stephanie Valdez Stretti, director of industry insights at Cox Automotive. “Growth is partly driven by incentives and discounts, but we can expect more adoption in the coming years as more affordable EVs enter the market and infrastructure improves.”

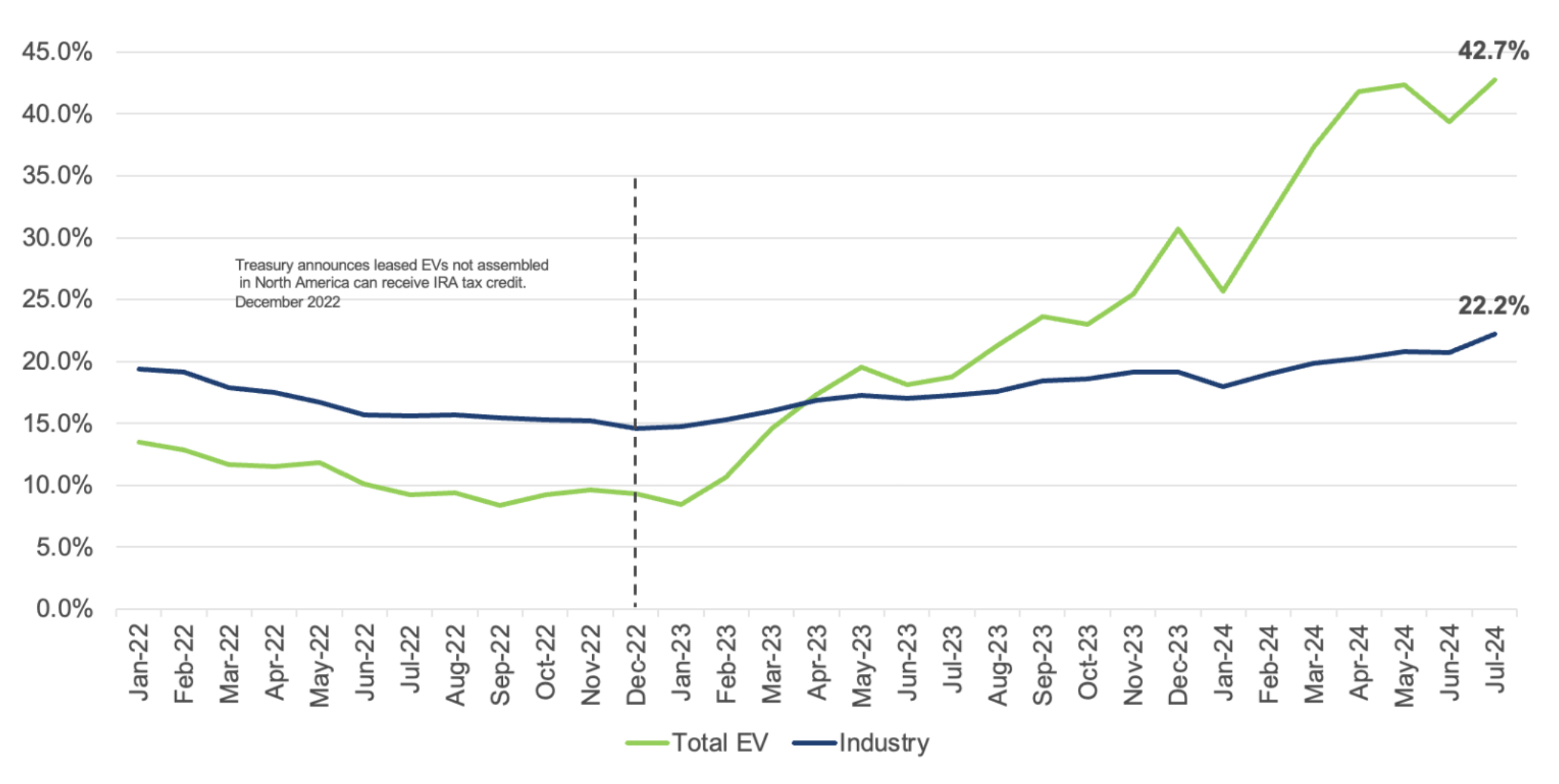

Tesla's total EV sales versus the rest of the industry

Credit: Cox Automotive

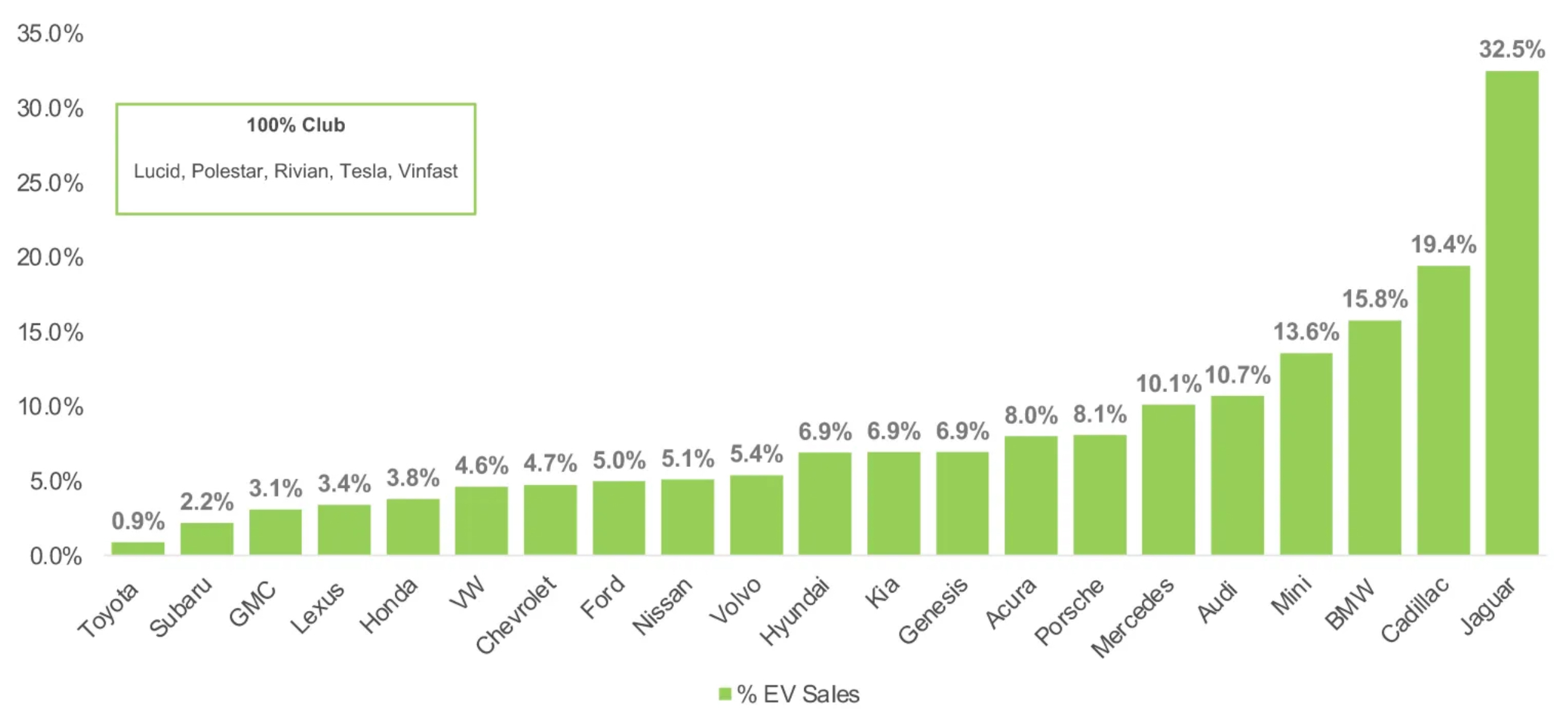

Q3 EV share of total brand sales

Credit: Cox Automotive

Cox said it expects growth to pick up in the coming months, and it says a 10 percent market share is “within reach,” especially with charging infrastructure and EV options in the market, as well as great incentives and discounts.

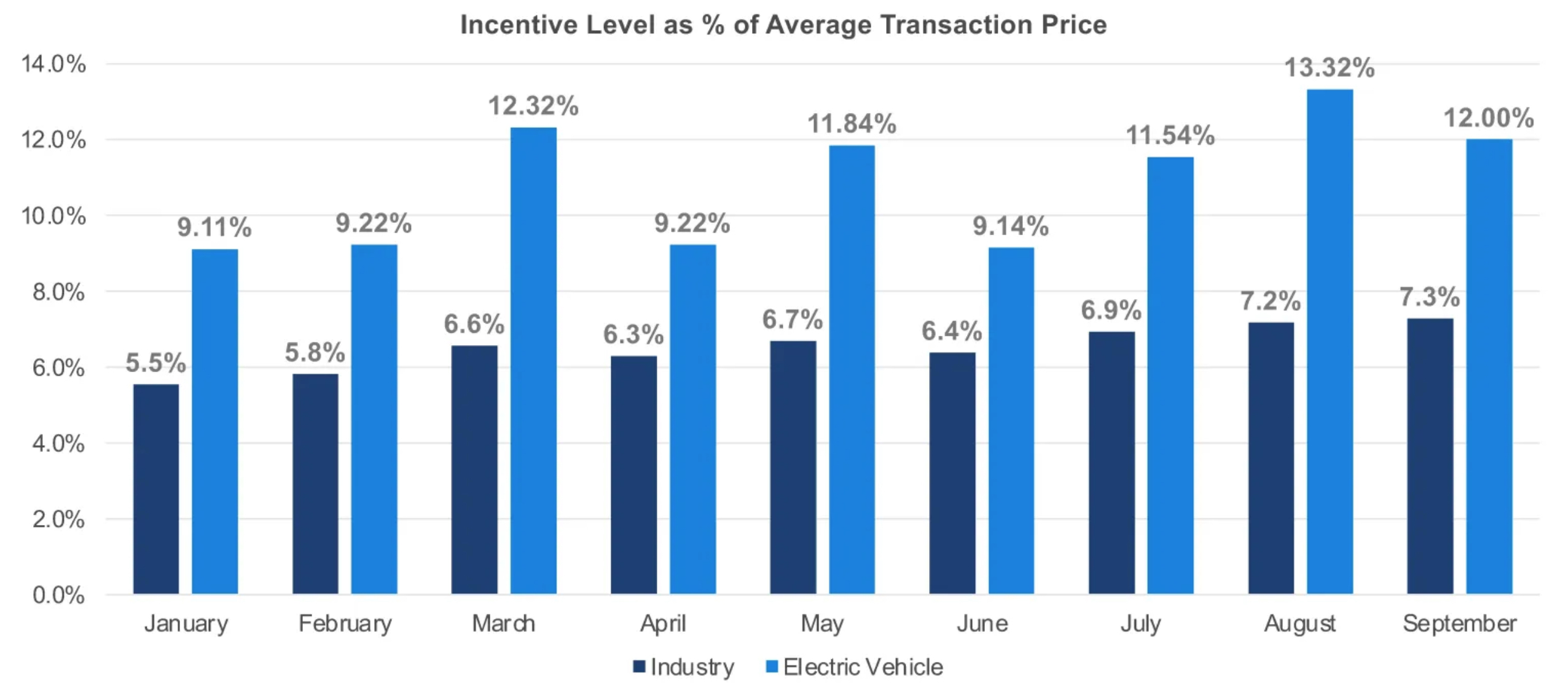

EV incentives also peaked in the third quarter, with leasing programs that gave automakers access to more generous government incentives. During the 3 quarters, incentives were more than 12 percent of the average transaction value (ATP) on sales, above the industry average of about 7 percent.

Cox reported in July that incentives reached a three-year high of around 11.54 percent of ATP on sales, before rising further to 13.32 percent in August. In September it fell slightly again, landing at 12 percent of ATP.

Retail vs. Industrial EV Lease Penetration

Credit: Cox Automotive

Credit: Cox Automotive

Tesla remains the clear EV market leader, even as consumer options continue to grow, with other automakers trying to ramp up their EV programs as they gain market share. In the 3rd quarter, Tesla delivered 166,923 vehicles in the US, marking a 6.6 percent year-over-year increase.

The report also noted that Tesla returned to growth mode in Q3 with sales up 6.6 percent, supported by the increasingly popular Cybertruck. Excluding the Model 3 (58,423) and Model Y (86,801), Tesla sold 16,692 Cybertrucks in Q3, outselling every other EV.

As for individual brands, Tesla was followed by Ford and Chevy in Q3, which sold 23,509 and 19,933 EVs, respectively.

Notably, General Motors (GM) EVs jumped 60-percent overall to 32,095 brand total units and surpassed Hyundai, which saw sales plateau at 29,609 units for the year.

You can see the full data from Cox Automotive here.

Experts discuss remaining obstacles to EV sales

What are your thoughts? Let me know at zach@teslarati.com, find me at X @zacharyviscontiOr send us tips at tips@teslarati.com.