INJ is setting up for a rally at $23 – but watch out for this risk!

- INJ stakeholders lost significant gains in the September rally.

- Now, the hope of a breakout depends on one key factor.

injection [INJ] Defying September's bearish trend, it rallied more than 40% last week to $23. However, a price correction in October erased much of that gain, pulling INJ back to previous levels.

Recently, the Injective Network announced key milestones, with a significant increase in the number of users and a 6% increase in the value of INJ.

Despite this brief rally, the rally was shortened by a bearish MACD crossover on the daily chart. Following this, AMBCrypto investigated whether this retracement could catalyze a breakout, as many analysts expect.

INJ in short supply

Injective's innovative burn auction, introduced with INJ 2.0 in 2023, simplified the token burning process.

In context, it enables individual users to contribute directly to the auction fund; INJ Network makes token burn more accessible.

Recently, the network announced an additional 200K INJ token burn, a move that is expected to positively impact INJ's price action in the long term.

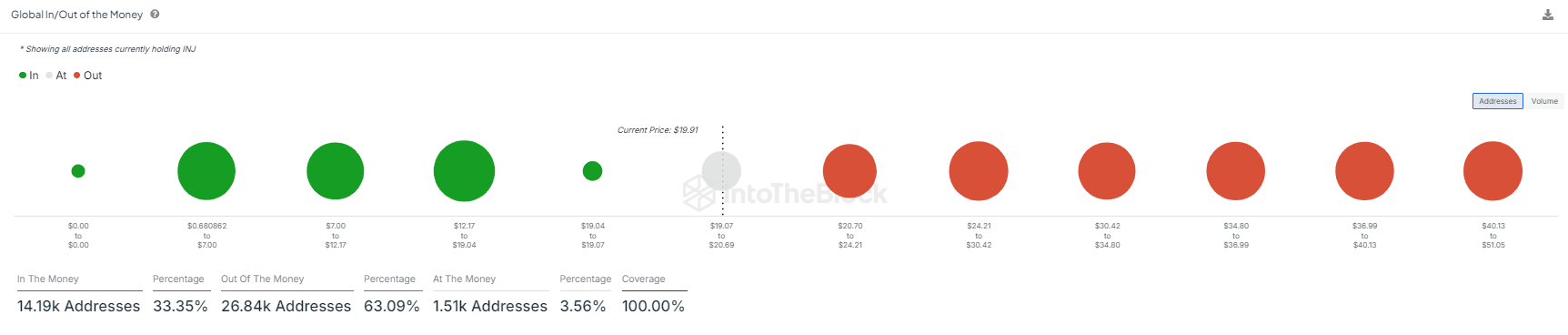

However, as AMBCrypto points out, the recent price retracement has pushed many INJ holders into loss positions. A significant portion of these investors held for 1.66 million INJ, which was acquired at an average price of $22, which is lower than the current trading price.

Source: IntoTheBlock

If other holders view the current price as a market bottom and decide to buy the dip, these investors may have an incentive to hold off on breaking even in addition to the previously mentioned network gains.

If this trend holds, the next big test of the injection will turn the previous $23 resistance into support, if they succeed, the next resistance could hit near $30.

Whales are supporting this idea

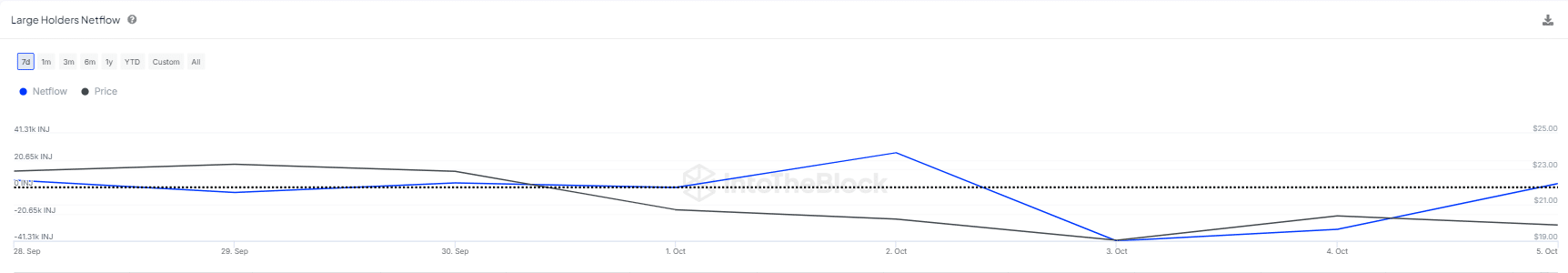

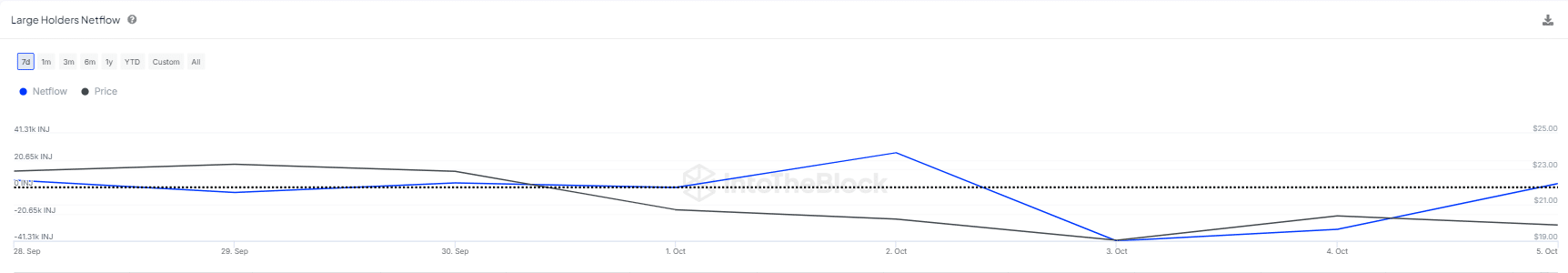

This week, large whale groups intervened to prevent the INJ from a deep pullback that could have sent prices down to $18. Their efforts led to a significant 7% gain, pushing INJ up to $20.

The chart below shows that approximately 45K INJ tokens flowed from the exchange to whale wallets, piling up during the dip and successfully flipping the $18 level to support.

Source: IntoTheBlock

While this is a bullish sign, a decline in whale holdings could pose a challenge for bulls trying to maintain the $23 level.

In summary, this rally points to a potential market bottom, encouraging loss position holders to maintain their holdings while drawing in profit holders through FOMO, which is crucial to establishing $23 support.

Read injection [INJ] Price Forecast 2024-2025

However, if the whales retreat, major players may lose confidence in the recovery, possibly pushing INJ back to $18.

Therefore, tracking termite activity for breakouts is essential. If whales remain committed to the long term, their confidence could help bulls hold support at $23, setting the stage for the next resistance at $30.