Dogecoin – Exploring why DOGE price may soon reverse further

- DOGE registered a gain of just over 1% in the last 24 hours

- Memecoin may be set for a breakout that could take it to $0.134

Last week, many memecoins recorded significant losses. Dogecoin [DOGE] Among them, crypto fell 12.4%.

In contrast, the last 24 hours have registered some moderate gains on the DOGE chart. In fact, at press time, Dogecoin was trading at $0.109.

Needless to say, Memecoin's prevailing price action has crypto analysts talking. One of them is Kevin Capital, an analyst predicting a possible upside on the chart citing a macro falling wedge trend.

Dogecoin Market Sentiment

In his analysis, Kevin posits that Dogecoin's latest price action is seeing some signs of a potential bullish recovery after rising above its macro bearish wedge trend over the past 48 hours.

Source: X

According to this analysis, the 48-hour recovery indicates that the recent breakout may be a false bearish signal and DOGE is now in a bullish backtest. As such, a successful backtest will confirm that the trendline of the wedge holds as support, leading to an upward breakout.

Generally, a falling wedge is usually a bullish reversal pattern, which occurs during a downtrend. This trend suggests that selling pressure is weakening and a breakout to the upside may be imminent.

Historically, a breakout from this trend is considered a bullish reversal, especially after an extended downtrend. When it forms, it means that buyers are gaining control.

For example, in 2021, Dogecoin saw a parabolic growth called a meme-driven bull market. During this period, DOGE rose 1333% in 2 days, reaching $0.0459. This was followed by a bullish move, with DOGE skyrocketing 10531% in 100 days, hitting an ATH of $0.70.

Therefore, if this analysis holds, DOGE will make significant gains on the price chart.

What does the chart say?

As observed above, prevailing market conditions may set Dogecoin up for further gains in the short term.

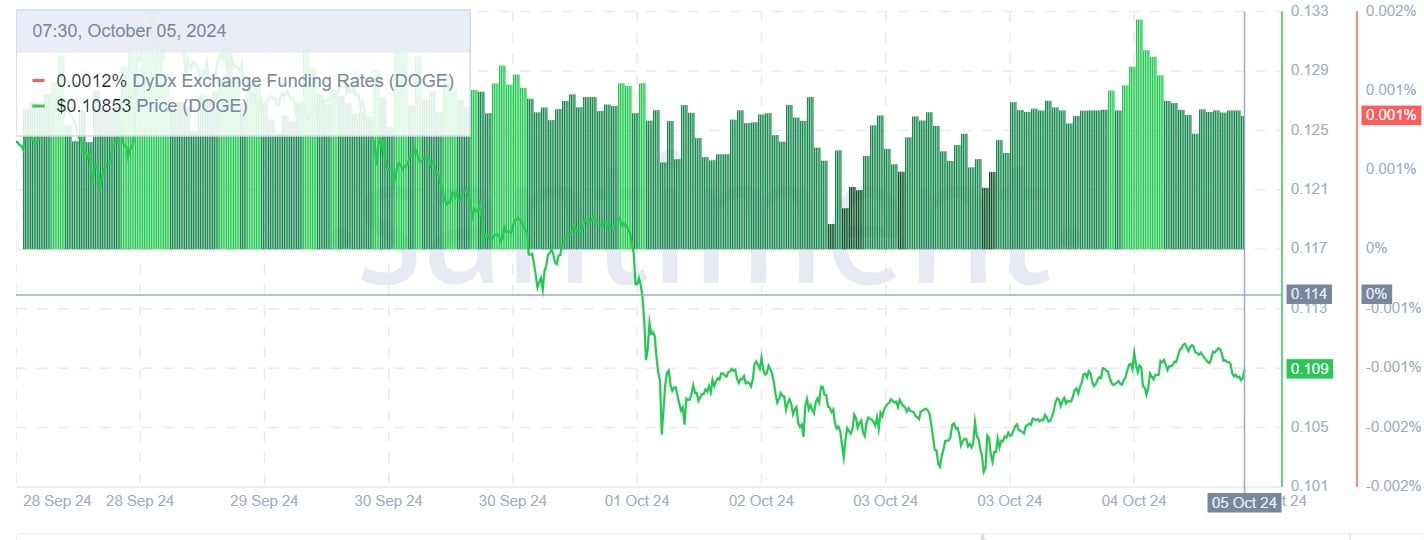

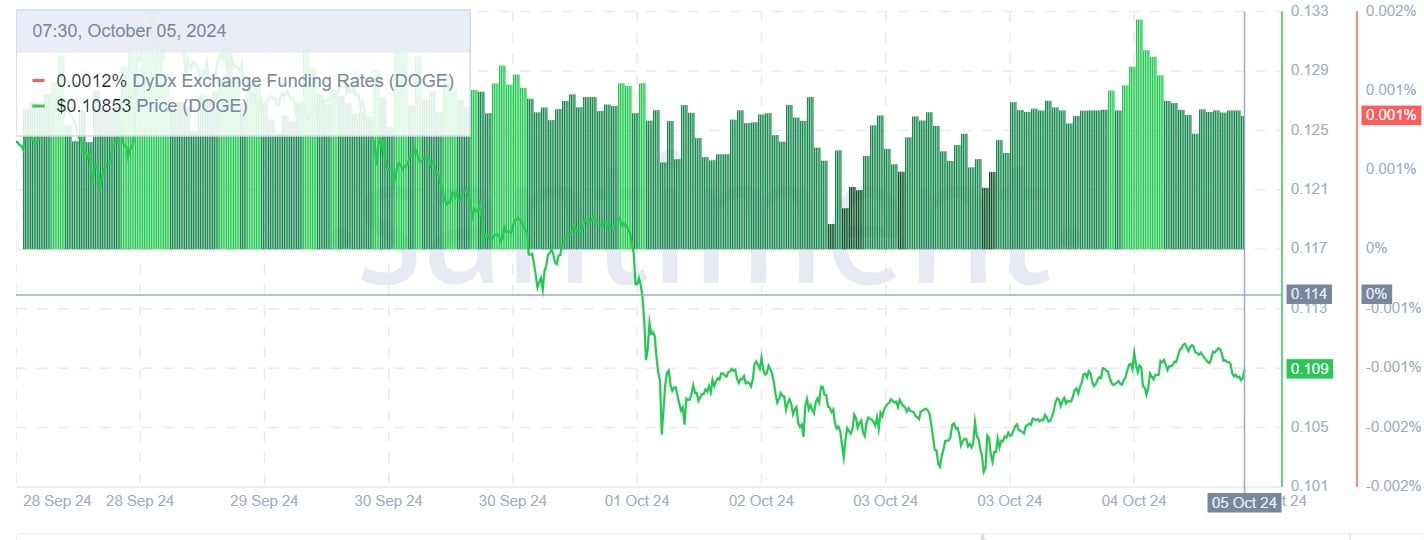

Source: Sandhi

For starters, Dogecoin's DyDx exchange funding rate has remained positive over the past week.

This means that long position holders are paying shorts during market downturns to hold onto their positions. Such market behavior is a sign of confidence in memecoin's potential.

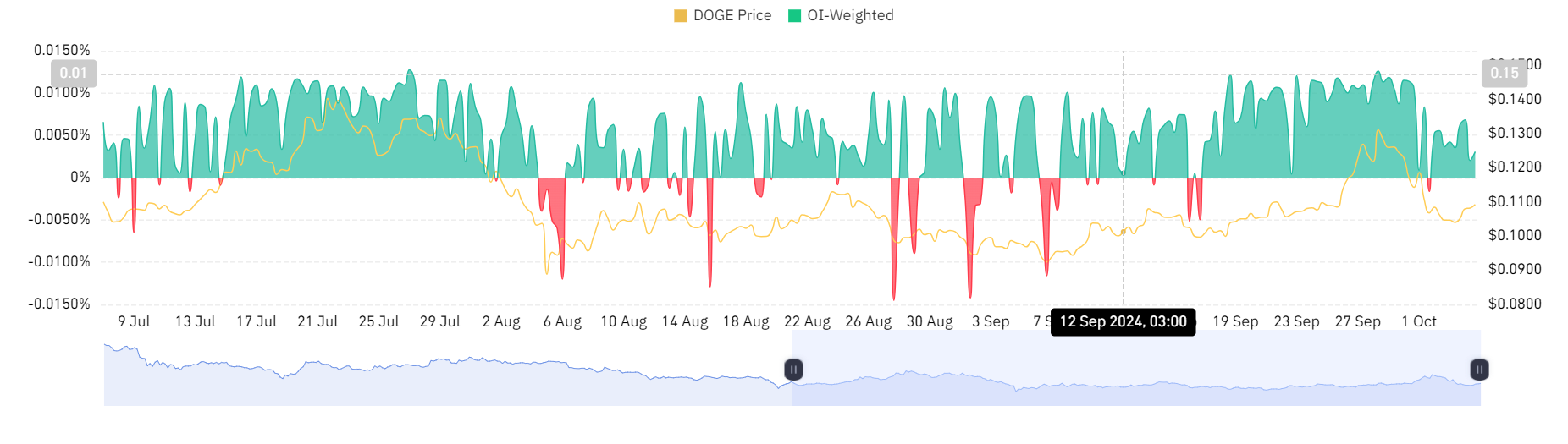

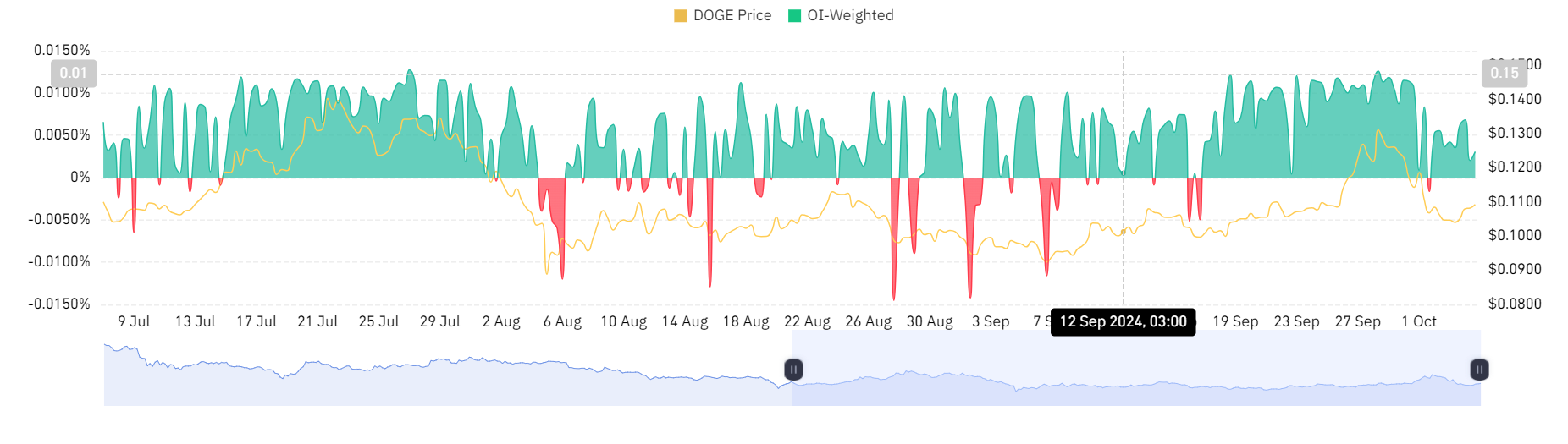

Source: Coyonglas

This demand for long positions can be further supported by positive open interest (OI) weighted funding rates.

Source: IntoTheBlock

Additionally, net flows to large holders rose to 563.1 million from 37.43 million last week. Such a rise implies that many large holders are increasing their investments and holdings, compared to those who are withdrawing to sell. This is a sign of confidence among major holders as they expect further price hikes.

Simply put, Dogecoin is on the receiving end of favorable market sentiment right now. If these conditions hold, DOGE will break out of the stubborn resistance level at $0.11105. A breakout from this level would see Memecoin hit $0.134.