Super Micro: Assessing Potential Risk and Reward

Super Micro Computer (SMCI) has had an incredible start to the year as shares quadrupled from January to mid-March. This growth made Super Micro eligible for inclusion in the S&P 500, the technology hardware stock (with links to AI) added to the index on March 18, 2024. Apparently, this would have been a great time to take profits or short the stock, as shares have fallen more than 50% since then.

A major breakthrough came in a report by Hindenburg Research, which contained troubling allegations about the company's financial reporting. I maintain a Neutral rating on the stock to evaluate those complaints along with Super Micro's fundamentals

Hindenburg expressed doubts about Super Micro

The Hindenburg report is actually the main reason I'm neutral rather than bullish on SMCI stock, and I believe it has caused hesitation among many AI stock analysts and investors.

The complaints are pretty straightforward. According to Hindenburg, Super Micro was engaged in accounting manipulation that included “sibling self-dealing and sanctions avoidance”. Anyone who thinks that term is too much may remember that in August 2020 the SEC charged Super Micro with massive accounting violations. The Hindenburg report also argues that most of those involved in accounting misconduct are back at Super Micro.

Hindenburg's team interviewed several Super Micro salespeople and employees while compiling their report. It doesn't help that Super Micro delayed its 10K filing to assess internal controls shortly after Hindenburg went public with its concerns. While this may just be a coincidence, the timing is alarming. Looking back several years, Super Micro failed to file financial statements in 2018 and was summarily delisted from the Nasdaq as a result.

Earlier this month, Super Micro publicly denied the allegations, with CEO Charles Liang hitting back, saying Hindenburg's report contained “misrepresentations of facts.” Super Micro has not issued any additional statements since then.

The rise of artificial intelligence is undeniable

Super Micro's status as part of the fast-moving world of AI is one of the few reasons I'm neutral rather than bearish on SMCI stock. The exciting prospects for the Company's business and the serious nature of Hindenburg's complaints largely offset each other.

It's hard to know what's real and what's fake, but most people agree that the AI industry as a whole offers compelling growth potential. Nvidia ( NVDA ) has been posting triple-digit year-over-year revenue growth for several quarters. Other tech giants have incorporated artificial intelligence into their core businesses and delivered impressive results for their shareholders. For example, Alphabet's ( GOOGL ) cloud revenue grew 28.8% year over year as many businesses rushed to build their own AI tools.

The artificial intelligence industry is also projected to maintain a 19.3% compound annual growth rate from now to 2034, according to Precedence Research. The AI industry should continue to grow, and it should lift Super Micro. The company should benefit from Nvidia's growth, which is why the company posted exceptional revenue and net income growth during Nvidia's ascent. It's what we've seen for a few quarters. We just don't know how accurate all the numbers were, if the allegations against the firm have merit.

Super Micro has strong financials at face value

While it's impossible to ignore Hindenburg's accusations against Super Micro, it's worth evaluating the company's previous quarterly results. Shares fell before Hindenburg released his report. While I argued in March 2024 that SMCI stock faced risk, I felt that Hindenburg presented a great opportunity to buy the shares in late summer until that optimism faded.

In its most recently reported quarter, Super Micro posted net sales of $5.31 billion, representing 143% year-over-year growth. Meanwhile, net income rose 82% year over year, to $353 million. At the time of release, my primary concern was Super Micro's shrinking net profit margin. Super Micro currently trades at a trailing P/E ratio of 20x, seemingly enough to offset any further erosion in profit margins. SMCI stock has a ridiculously low 13.6x forward P/E ratio, but on recent momentum (the Hindenburg report and the DOJ investigation) investors seem reluctant to bid up the valuation multiple right now.

We still have no real evidence that Super Micro has committed any wrongdoing as alleged by Hindenburg. Their report, however, gave the stock a black eye. I expect Super Micro to significantly outperform its fiscal 2023 results even excluding any errant transactions.

The Department of Justice is investigating Super Microcomputers

The Super Micro controversy added a new chapter on September 26, as the US Department of Justice is now investigating the company. SMCI stock fell an additional 12% on the news, and shares recently traded less than one-third of their all-time high in March. The shares have a high risk/reward at the moment, but the higher risk sidelines me with a neutral rating.

Super Micro shares bounced back more than 4% on Friday, September 27, suggesting that many investors believe the business's long-term prospects are worth the heightened uncertainty.

Is Super Micro stock rated a buy?

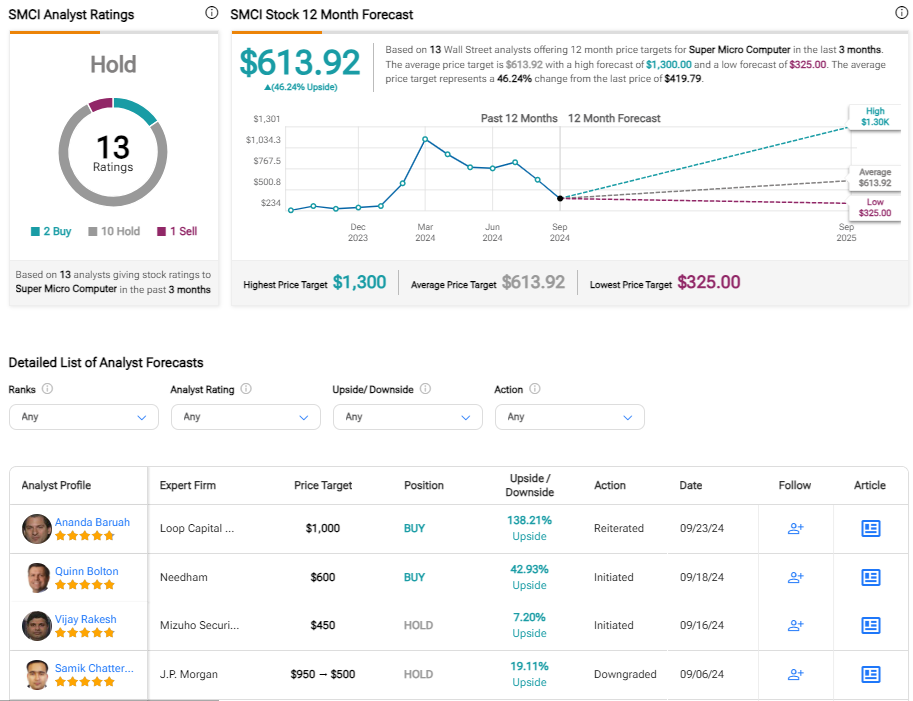

While ratings for this stock could change rapidly, Super Micro currently has 2 buy ratings, 10 hold ratings, and 1 sell rating from the 13 analysts that cover the stock. SMCI has an average price target of $613.92, suggesting a potential upside of about 50%. Again though, it is quite possible that several research brokerages have kept their SMCI ratings under review. SMCI stock has some lower price targets including CFRA, Wells Fargo ( WFC ), and Susquehanna at $454, $375, and $325, respectively. All of these price targets were established before the DOJ probe was announced, so even they could come down

The bottom line of SMCI stock

There is an old saying that suggests, “You either die a hero or live long enough to be a villain”. That quote seems apropos for this company. Super Micro's stock price rose above $1,000 per share, earning many investors huge profits. Late entrants to the story, including after SMCI stock was added to the S&P 500, did not fare well. Many investors are sitting on significant losses right now. Depending on what those investors do, it's hard to say how much more downside Super Micro shares might have until there's more clarity on the ordeal.

If the company's recent financials are accurate, SMCI shares look pretty attractive here. Shares could rise sharply if the Hindenburg report loses relevance, though that outcome is hard to predict. I'm a big fan of Super Micro's industry and the business potential associated with AI, which prevents me from being downright bearish. I have a neutral position here. Meanwhile, I don't expect SMCI's shares to rise above $460 (estimated price prior to news of the DOJ investigation) without some resolution to the two main threats to shareholder value.

disclosure