Celestia Unlocks $1.06B in TIA: Price Increase or Next Sell Off?

- Celestia's $1.06 billion TIA unlock sets an important test for upcoming, key support levels.

- Bearish sentiment prevails with low social engagement and negative funding rates despite impending liquidity.

Celestia [TIA] The token is on the verge of a major turnaround as it prepares to unlock $1.06 billion worth of tokens, which is about 80% of its supply. With TIA trading at $5.37, up 0.87% at press time, this influx of liquidity could significantly affect the token's market direction.

Many investors now wonder if the unlocked tokens will create new demand or increase selling pressure, thereby reversing TIA's current trend.

TIA Price Action Analysis: Consolidation or Breakout?

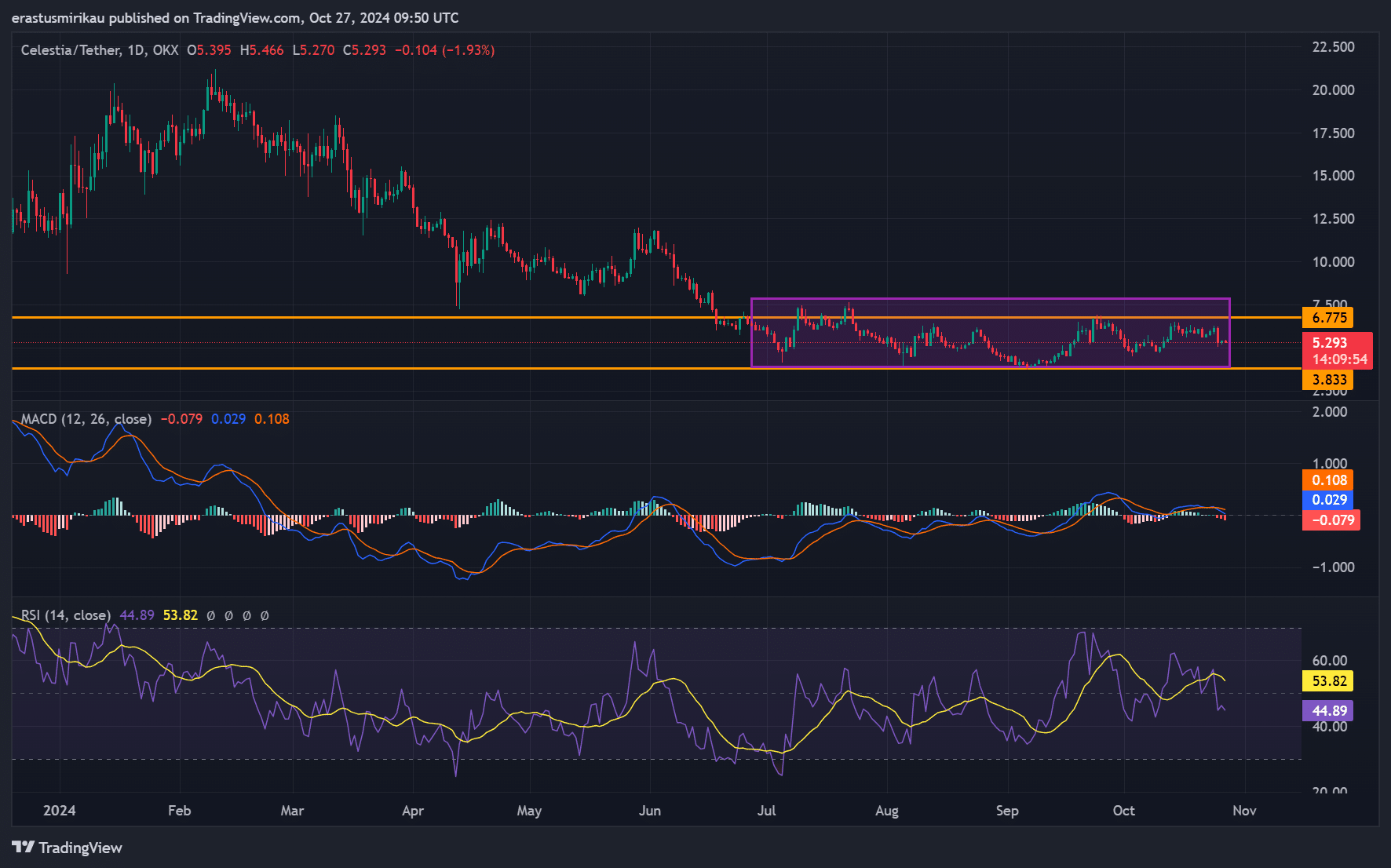

The daily Celestia chart reveals a trading range between $3.83 and $6.77, where the token has been consolidating for months. Currently, TIA is hovering around $5.29 with signs of slight bearish momentum.

The MACD indicator suggests weakening bullish momentum with signal lines close to zero. Additionally, the RSI, sitting below 50, indicates limited bullish strength.

However, with the unlock event approaching, Celestia may be at a turning point. If buyers enter, the price could break the $6.77 resistance, sparking an upward move.

Conversely, if the market reacts unfavorably, TIA could slide towards its $3.83 support level, indicating a potential breakout.

Source: TradingView

Is TIA attracting enough social interest?

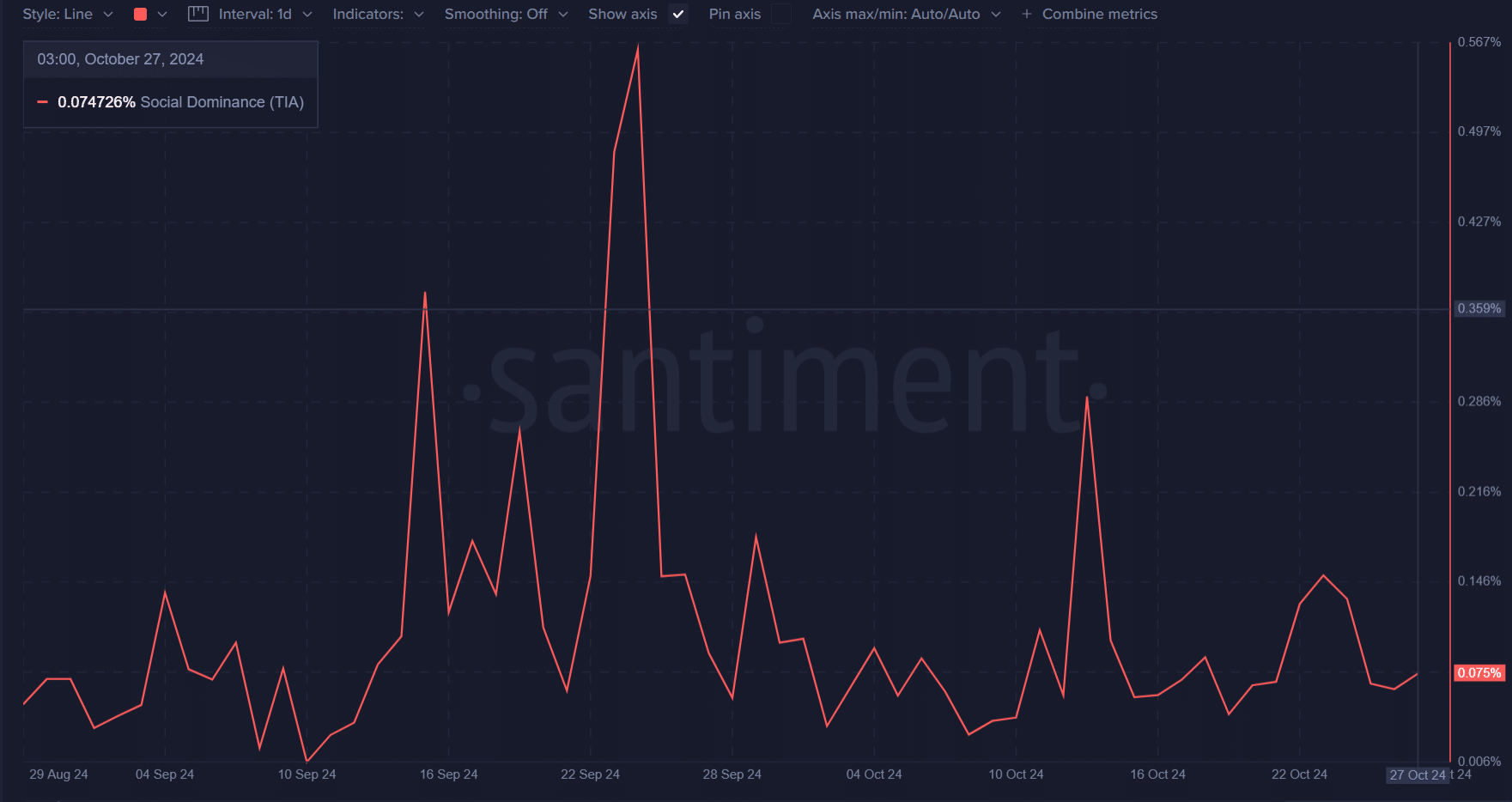

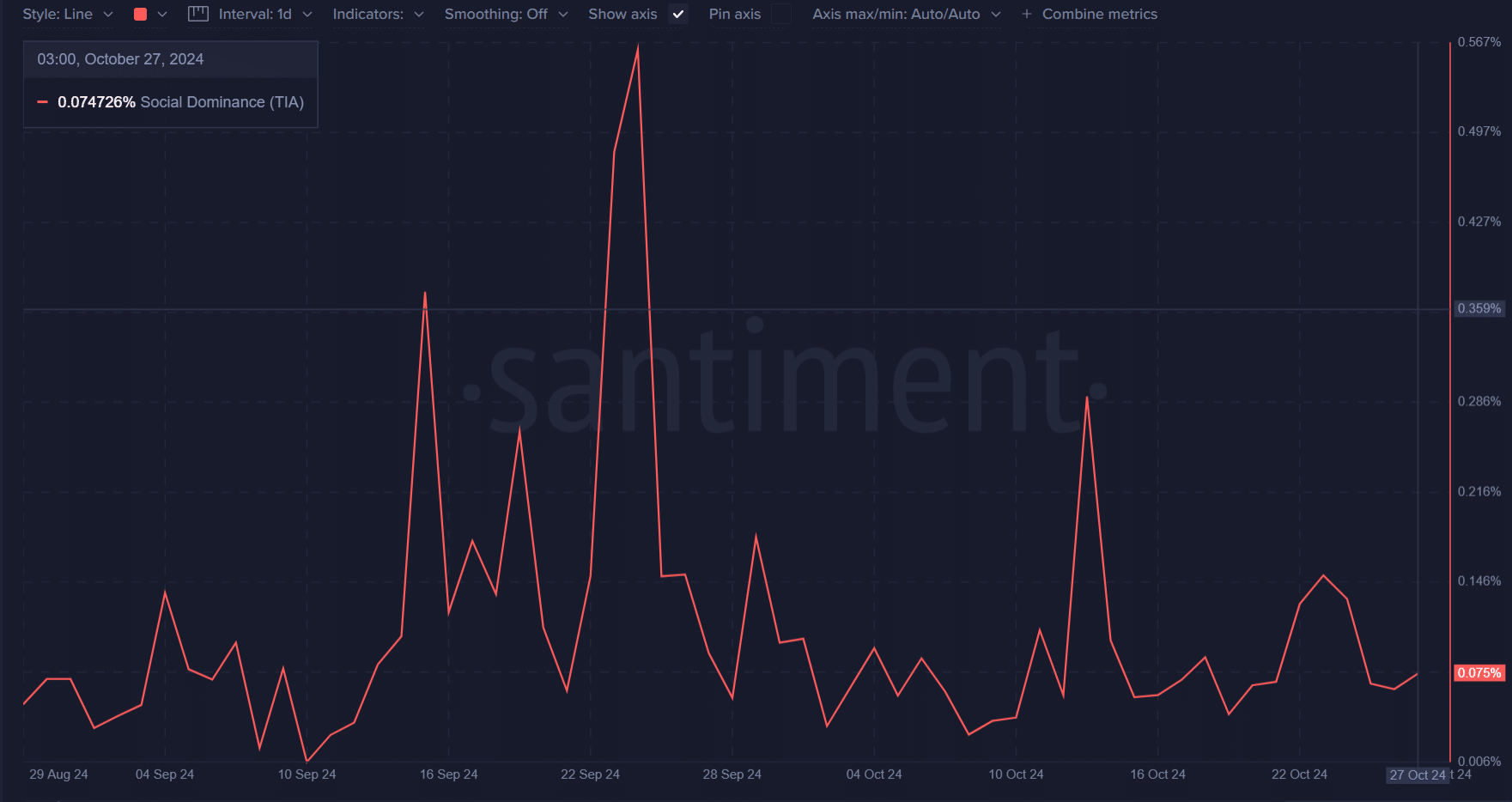

Celestia shows sporadic spikes in social dominance charts, especially in mid-September and early October. However, recent data reveals suppressed social activity, currently hovering around 0.075%. This limited engagement suggests that TIA has yet to capture the attention of the wider market.

Lack of social attraction may indicate minimal retail excitement until unlocked. An increase in social dominance can lead to new interest, potentially aiding a breakout.

However, if TIA continues to lack social momentum, it may struggle to gain traction despite significant liquidity flows.

Source: Sentiment

Funding rates hint at bearish sentiment

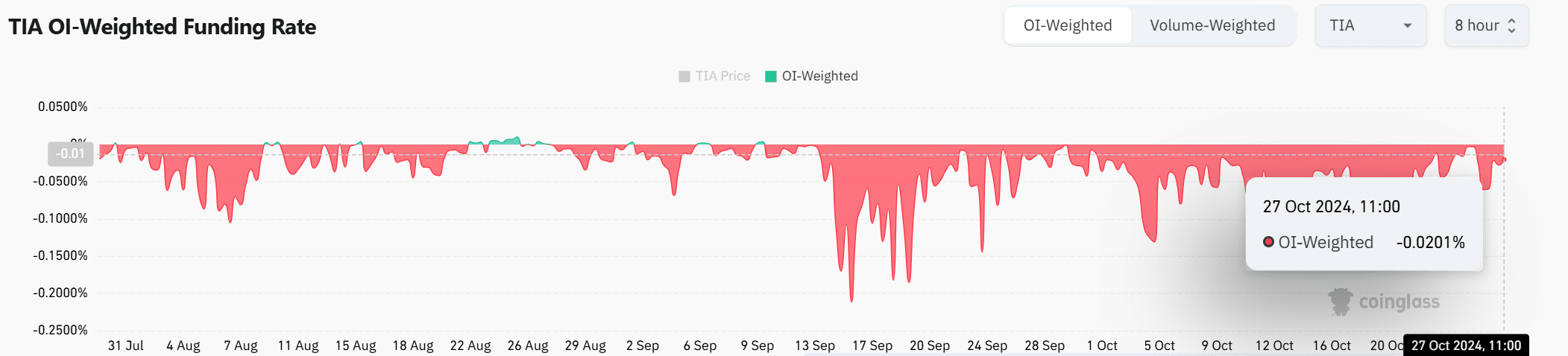

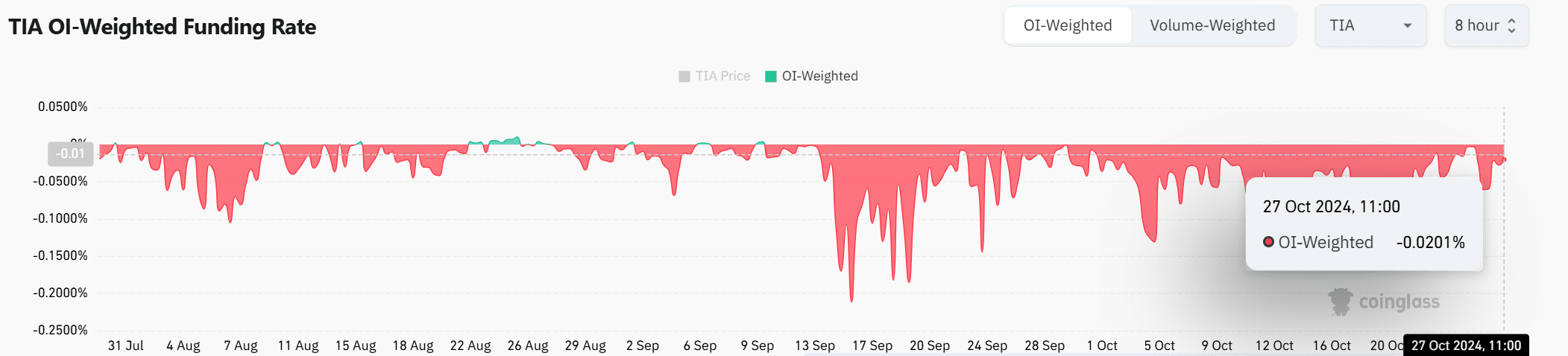

TIA's OI-weighted funding rate remains in negative territory, most recently at -0.0201%, indicating that short positions dominate the futures market. This trend highlights a cautious attitude, as many traders seem to be betting on a decline in prices.

However, if the unlock event triggers renewed buying interest, a shift toward a neutral or positive funds rate could indicate a sentiment reversal, supporting a potential rally.

Therefore, monitoring fund rate trends can provide insight into broader market expectations surrounding Celestia's price direction.

Source: Coyonglas

Is your portfolio green? Check TIA Profit Calculator

Ultimately, Celestia's massive $1.06 billion unlock puts TIA at a critical juncture. While the token price currently sits within a stable range at $5.37, some indicators reflect bearish sentiment, including low social dominance and a negative funding rate.

As a result, Celestia's next move largely depends on how the market absorbs the flow of unlocked tokens. An increase in interest or a positive fund transfer can cause the TIA to rise; Otherwise, the token may struggle to maintain its value, making this event critical to Celestia's future.