Headers Turn Bearish: Can HBAR Survive Its 90% Drawdown?

- Hedera prices are falling even as institutional interest fades.

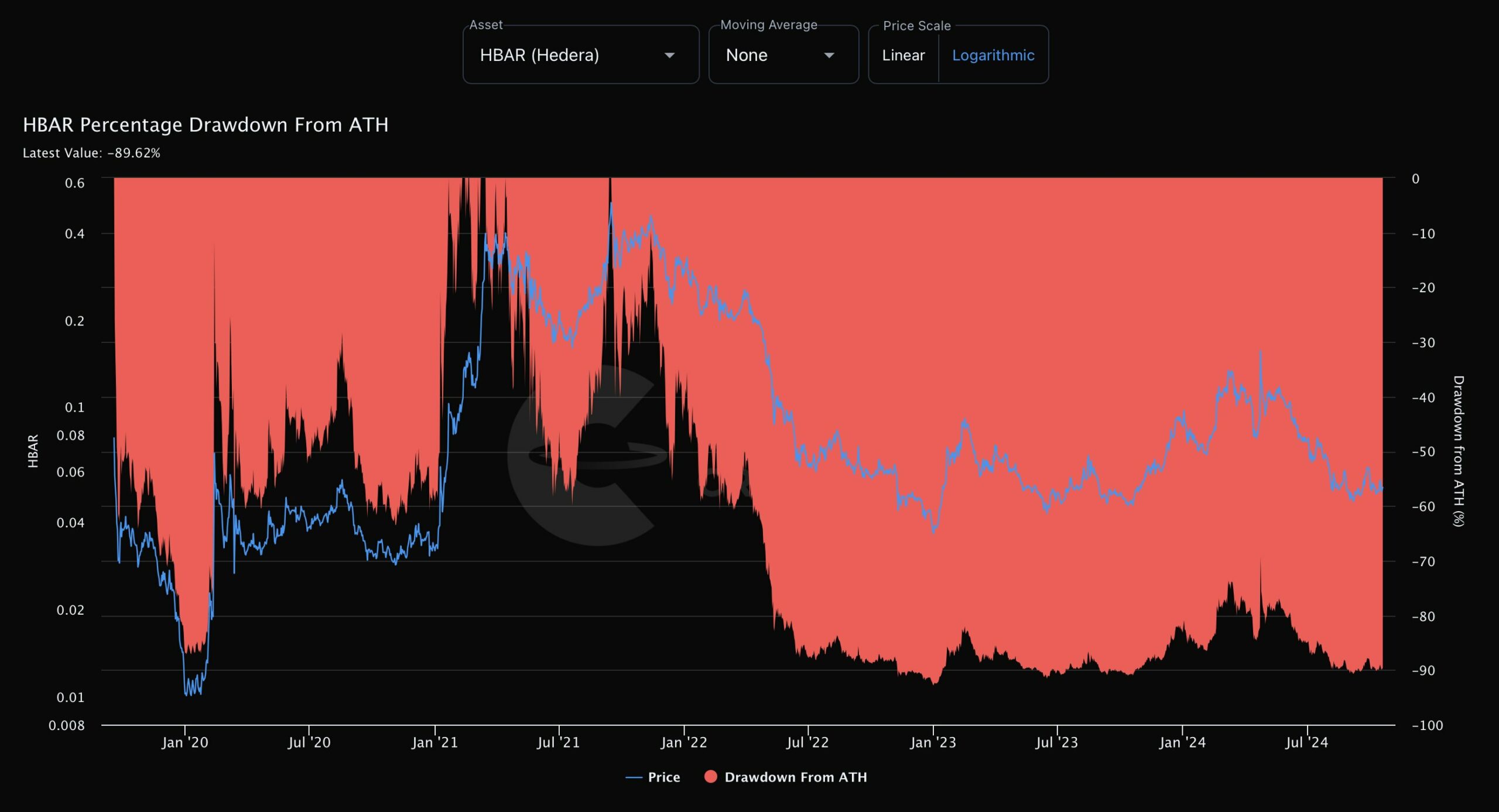

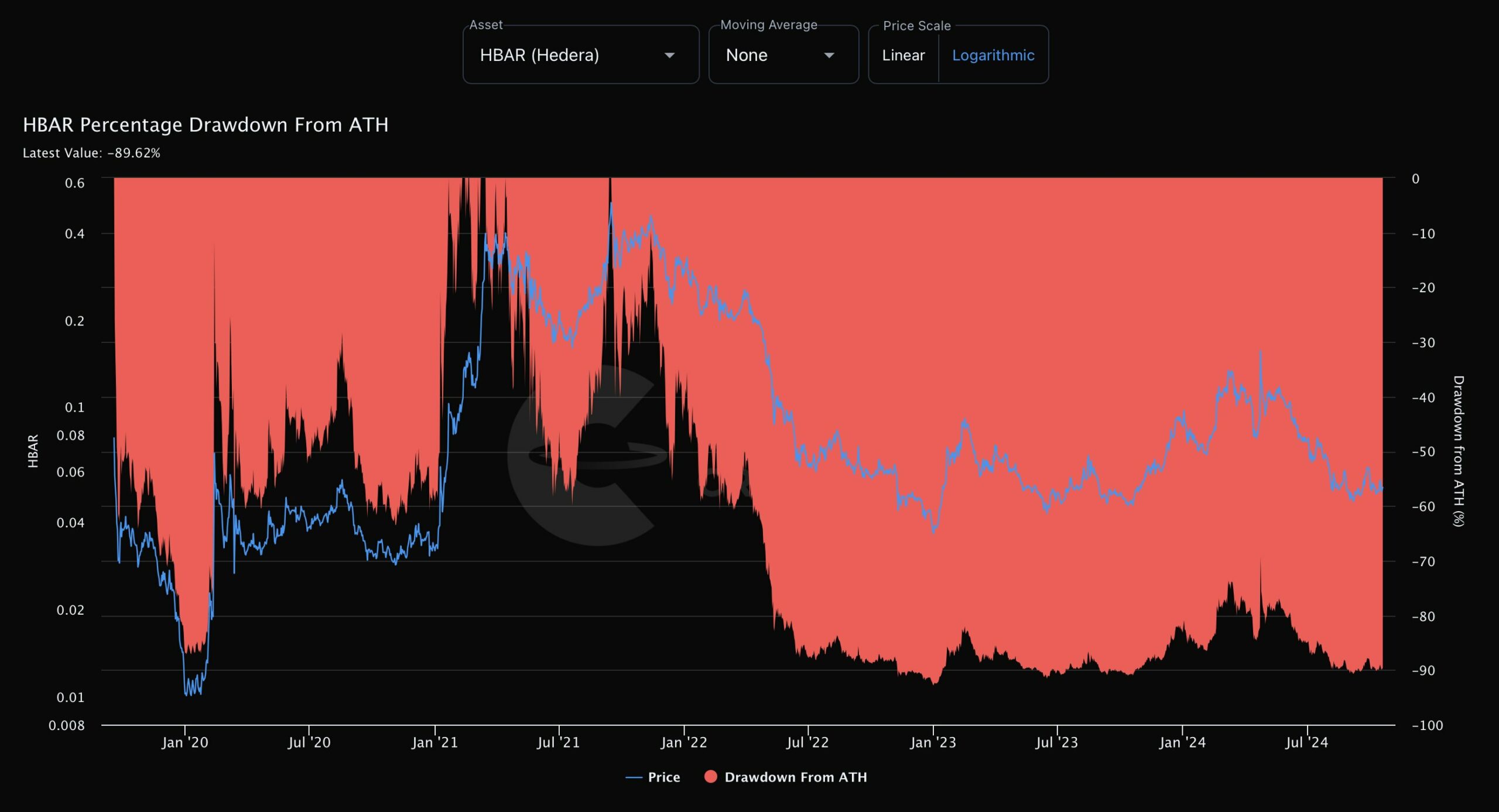

- HBAR, as of press time, was 90% below its all-time high.

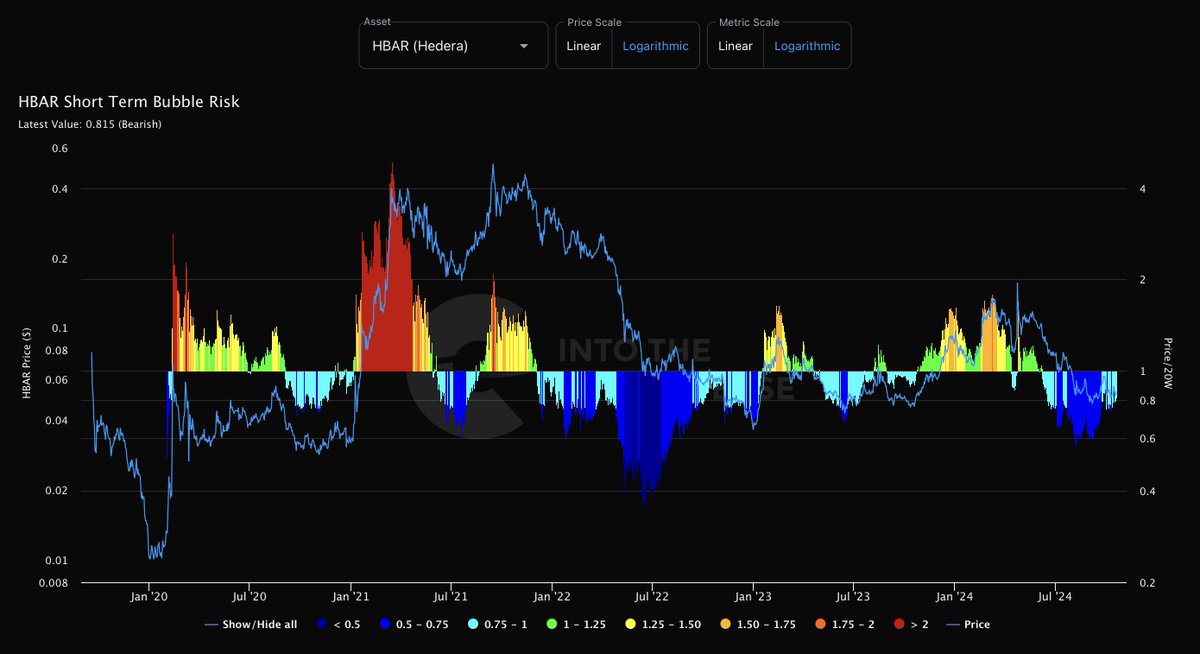

ivy [HBAR] Short-term bubble risk has turned bearish. This change raises questions about the future of the HBAR token price. Recently, Hedera has attracted more attention from crypto enthusiasts.

In the coming months and years, institutional investors are expected to pour significant funds into HBAR, potentially leading to price appreciation.

Notably, Morocco recently announced a 2030 digital strategy driven by Hedera, which aims to deploy the network across the country. Additionally, the US HBAR Trust gained institutional access with the launch of the Canary Trust.

Source: IntoTheCryptoverse

Despite this, HBAR currently faces short-term bubble risks and struggles with its token value, although adoption and real-life applications are increasing.

HBAR price action and BTC evaluation

The daily chart for HBAR reveals a bearish trend, confirmed by the short-term bubble risk indicator.

While the long-term outlook remains bullish, the $0.036 price serves as an invalidation point for a bullish scenario as the ascending trendline is canceled first.

Currently, the bullish outlook is not clear, as the upward momentum is more like a diagonal pattern. HBAR needs to reverse its current price trajectory which is steadily declining.

A significant break above $0.064 is essential to indicate a possible bullish comeback. Observing the patterns on multiple timeframes shows that a double bottom has formed, suggesting that the current bearish trend may not last long.

Source: TradingView

Moreover, HBAR is experiencing weakness against Bitcoin, indicating that the bearish trend may continue before any bullish recovery. Its BTC valuation is at its lowest level since 2020, raising concerns about HBAR's immediate future.

Percentage drawdown

Additionally, Hedera's price was 90% below its all-time high at press time, reinforcing the bearish outlook for HBAR. Historically, when the percentage from an all-time high reaches 90%, it often precedes subsequent gains.

Thus, despite the current decline in prices, Hedera remains a project to watch closely. Real use cases of the platform can ultimately support and increase its token value.

Is your portfolio green? Check out the HBAR Profit Calculator

While Hedera faces short-term challenges, its long-term prospects are promising. Institutional interest and real-world applications of HBAR may drive future growth.

Traders should monitor key price levels and market trends as HBAR navigates these critical times. By keeping an eye on market developments and institutional movements, investors can better understand Hedera's future and its potential to move higher.