76% of XRP traders prefer to go long: good news for the altcoin?

- XRP futures open interest showed a positive increase of 2.3% in the last four hours.

- XRP's OI-weighted funding rate indicated that traders were bullish, as long positions were paying short positions.

In the ongoing sideways cryptocurrency market, XRP traders on Binance look bullish as they significantly increased their long positions in the last four hours till press time.

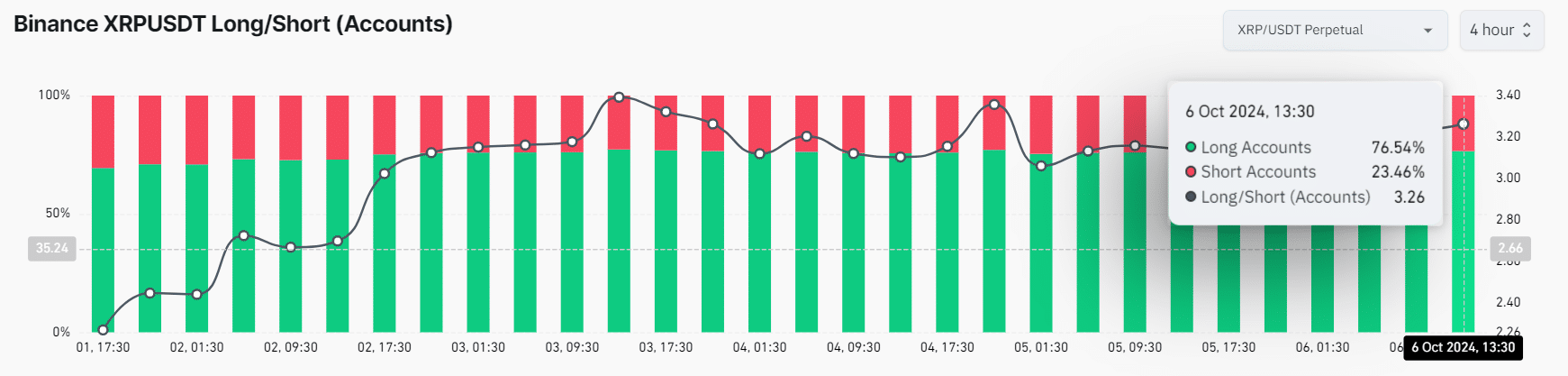

According to on-chain analytics firm Coinglass, 76.54% of Binance traders go long the XRPUSDT pair, while 23.46% prefer short positions.

Binance traders go long on XRP

This significant long position on Binance suggests that traders are optimistic about the price of XRP rising in the coming days.

However, this bet on significant long positions occurred when XRP was struggling to gain momentum near the strong support level of $0.52.

Source: Coyonglas

At press time, XRP was trading near $0.529 and has lost 0.65% in value over the past 24 hours.

Meanwhile, traders and investors remained hesitant to participate, as its trading volume fell by 50% from the previous day.

XRP's Bullish On-Chain Metrics

Despite the fear in the market, XRP's future open interest showed a positive increase of 2.3% in the last four hours. This indicates that traders' bets are increasing, which could be a bullish signal for XRP holders.

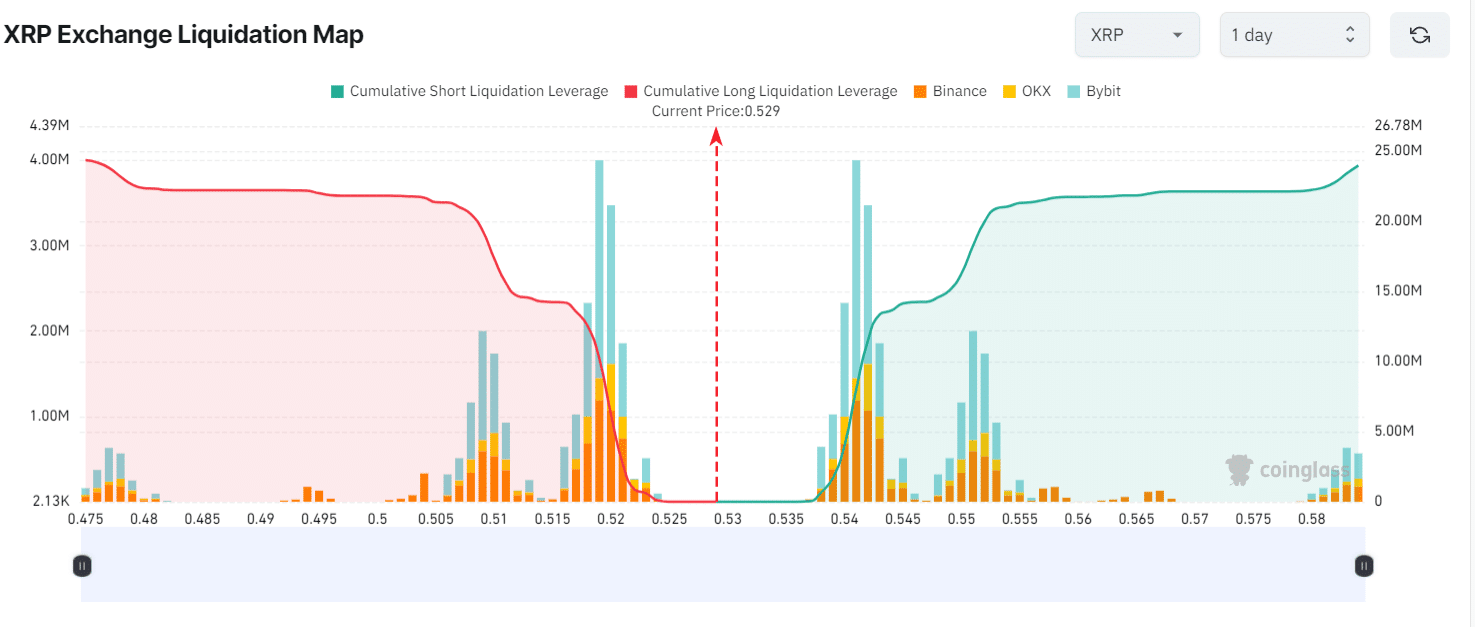

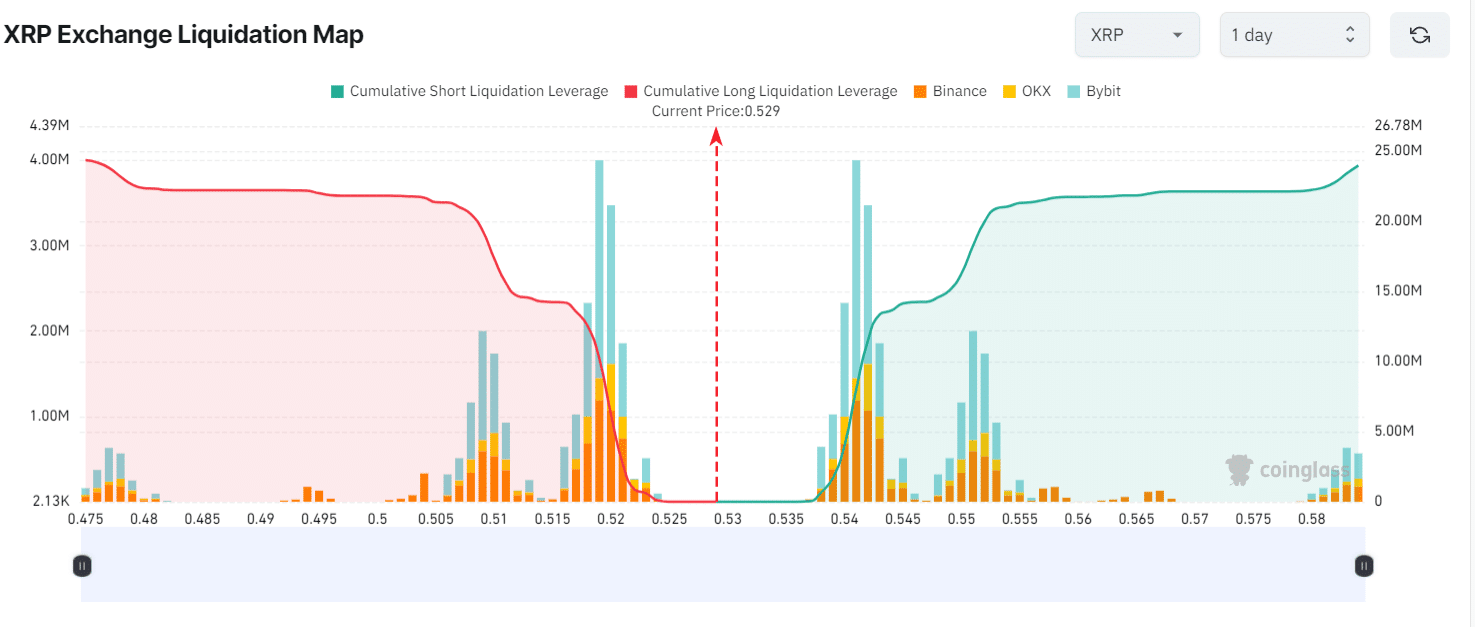

So far, major liquidation levels have been at $0.519 on the downside and $0.541 on the upside, with traders overleveraging these levels, according to Coinglass data.

Source: Coyonglas

If the market sentiment turns negative and the price of XRP falls below the $0.519 level, the long position worth about $10.21 million will be liquidated.

Conversely, if sentiment improves and prices rise to the $0.541 level, about $8 million worth of short positions will be liquidated.

However, another on-chain metric supporting this bullish view is XRP's open interest (OI)-weighted funding rate, which stood at +0.0097% at press time.

A positive funding rate indicates that traders are bullish, as long positions are paying off short positions.

Combining data from long/short ratios, futures open interest, liquidation levels and funding rates shows that bulls are currently dominating the asset, expecting prices to rise.

XRP Technical Analysis and Key Levels

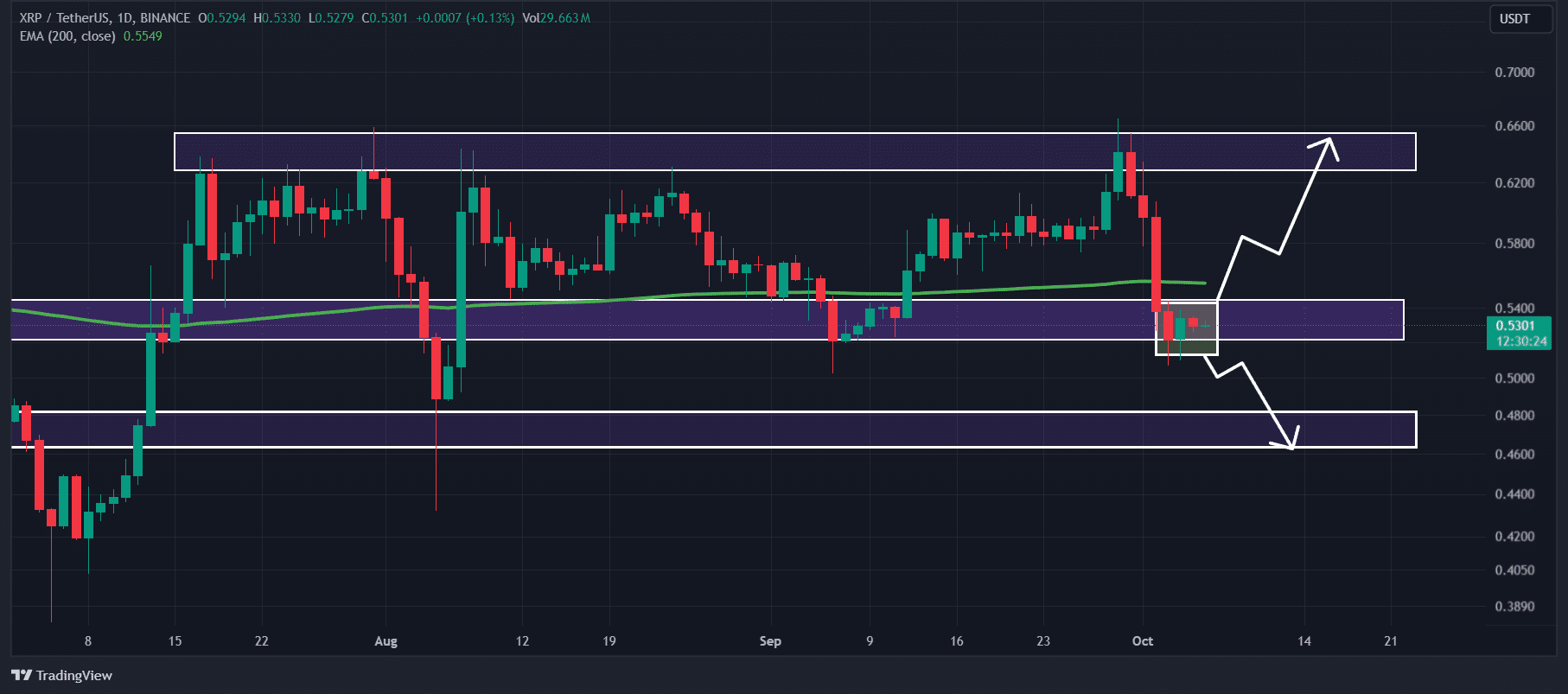

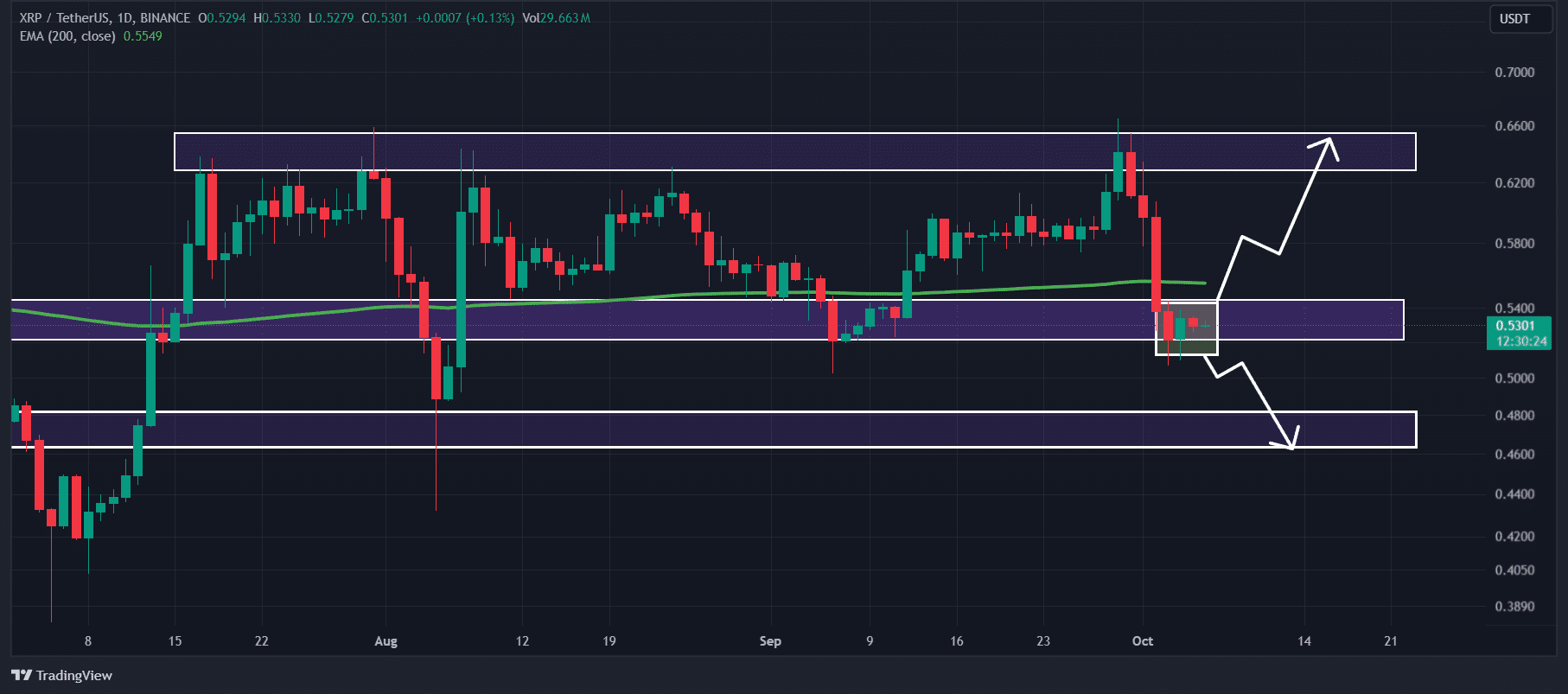

According to AMBCrypto's technical analysis, XRP has been consolidating in a tight range between $0.518 and $0.545 for the past three days, close to the important support level at $0.52.

However, a breakout from this consolidation zone will determine the next movement of XRP's price.

Source: TradingView

Read XRP Price Prediction 2024-2025

Based on historical price momentum, if XRP breaches the zone and closes a daily candle above the $0.545 level, there is a strong possibility that it could rise by 17% to reach the $0.65 level.

Conversely, if XRP breaches the lower boundary of the consolidation zone and closes a daily candle below $0.515, it may drop 12% to $0.455 in the coming days.